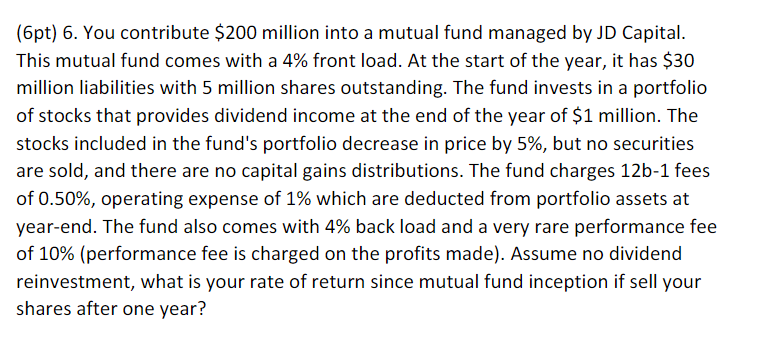

Question: ( 6 pt ) 6 . You contribute $ 2 0 0 million into a mutual fund managed by JD Capital. This mutual fund comes

pt You contribute $ million into a mutual fund managed by JD Capital.

This mutual fund comes with a front load. At the start of the year, it has $

million liabilities with million shares outstanding. The fund invests in a portfolio

of stocks that provides dividend income at the end of the year of $ million. The

stocks included in the fund's portfolio decrease in price by but no securities

are sold, and there are no capital gains distributions. The fund charges fees

of operating expense of which are deducted from portfolio assets at

yearend. The fund also comes with back load and a very rare performance fee

of performance fee is charged on the profits made Assume no dividend

reinvestment, what is your rate of return since mutual fund inception if sell your

shares after one year?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock