Question: 6. Road Runner, Inc. needs to replace an old solder bath machine with a new, more efficient model. The old solder bath machine was purchased

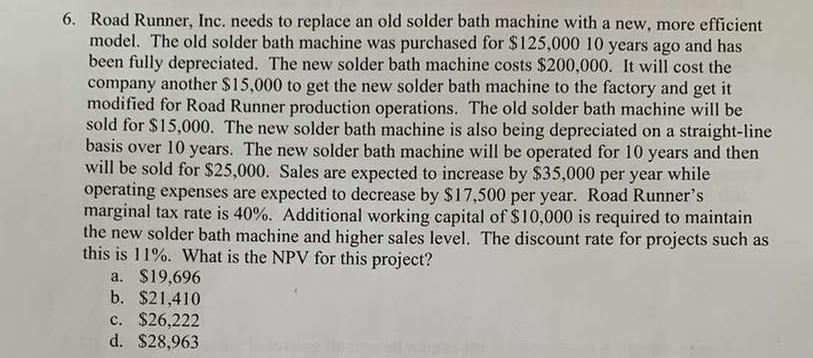

6. Road Runner, Inc. needs to replace an old solder bath machine with a new, more efficient model. The old solder bath machine was purchased for $125,000 10 years ago and has been fully depreciated. The new solder bath machine costs $200,000. It will cost the company another $15,000 to get the new solder bath machine to the factory and get it modified for Road Runner production operations. The old solder bath machine will be sold for $15,000. The new solder bath machine is also being depreciated on a straight-line basis over 10 years. The new solder bath machine will be operated for 10 years and then will be sold for $25,000. Sales are expected to increase by $35,000 per year while operating expenses are expected to decrease by $17,500 per year. Road Runner's marginal tax rate is 40%. Additional working capital of $10,000 is required to maintain the new solder bath machine and higher sales level. The discount rate for projects such as this is 11%. What is the NPV for this project? a. $19,696 b. $21,410 c. $26,222 d. $28,963

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts