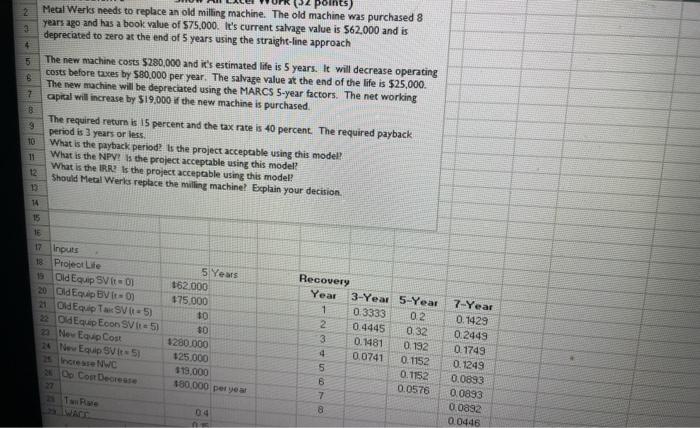

Question: need help problem 2 2 3 4 points) Metal Werks needs to replace an old milling machine. The old machine was purchased 8 years ago

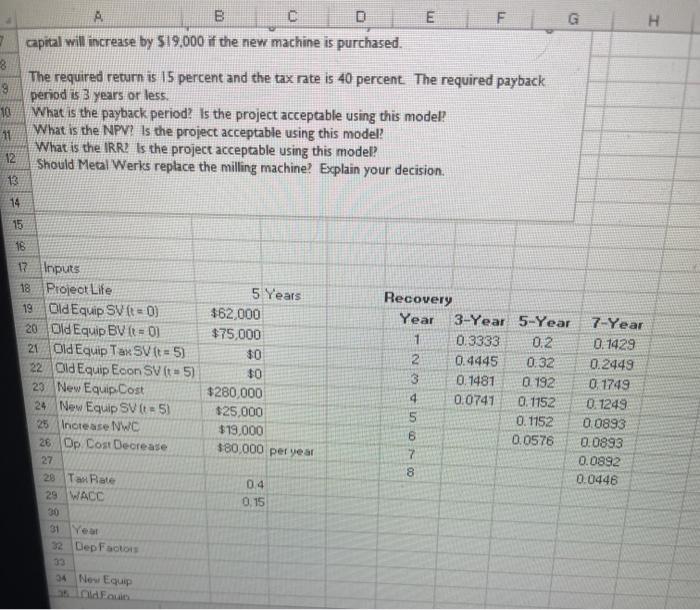

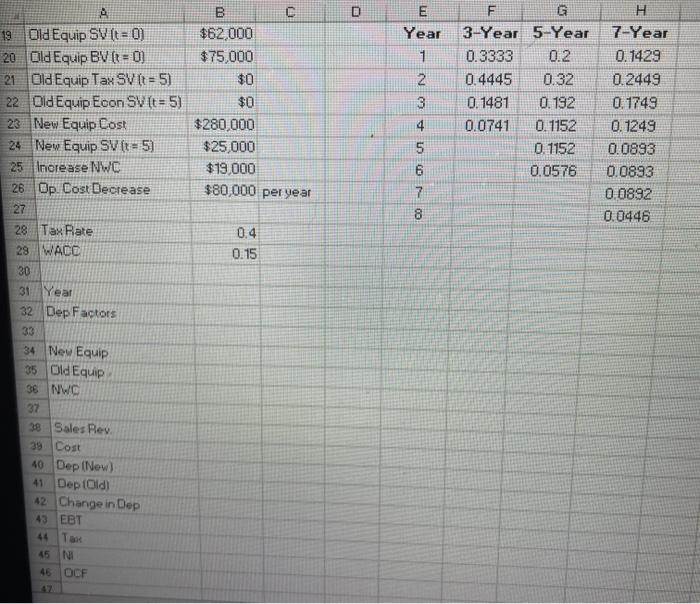

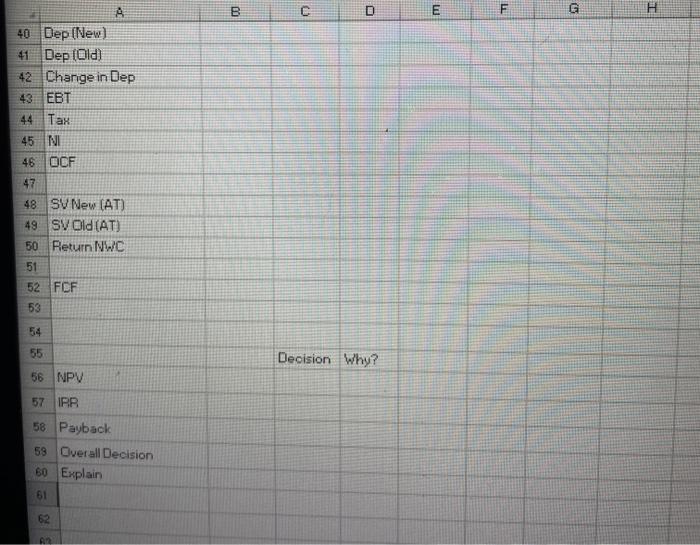

2 2 3 4 points) Metal Werks needs to replace an old milling machine. The old machine was purchased 8 years ago and has a book value of $75,000. It's current salvage value is 562,000 and is deprecated to zero at the end of 5 years using the straight-line approach 5 6 The new machine costs $280,000 and it's estimated life is 5 years. It will decrease operating costs before taxes by 580.000 per year. The salvage value at the end of the life is $25,000 The new machine will be depreciated using the MARCS 5-year factors. The net working apical will increase by $19.000 f the new machine is purchased 2 B 3 10 The required return is 15 percent and the tax rate is 40 percent. The required payback period is 3 years or less What is the payback period? Is the project acceptable using this model What is the NPV? Is the project acceptable using this model? What is the IRR is the project accepable using this model? Should Metal Werks replace the milling machine! Explain your decision 11 13 14 15 1E 17 Inputs 13 Project Lite Old Equip SV t-01 20 Old Equip BV it) 21 Old Equip TaxSV-5) 22 OdEquip Econ SV 15) 2 New Equp Cost 24 Equp SVI 5) Increase NWC Do Con Decrease 5 Years 162.000 175.000 10 $0 $280.000 $25.000 $19.000 180.000 per year Recovery Year 3-Year 5-Year 1 0.3333 02 2 0.4445 0.32 3 0.1481 0 192 4 00741 0.1152 0.1152 6 0.0576 7 8 ON- 7-Year 0.1429 0.2449 0.1749 0.1249 0.0893 0.0893 0.0892 0.0446 Twe 04 20 E F G H A B C D capital will increase by $19,000 if the new machine is purchased. 7 8 9 10 11 12 The required return is 15 percent and the tax rate is 40 percent. The required payback penod is 3 years or less What is the payback period? Is the project acceptable using this model? What is the NPV? Is the project acceptable using this model? What is the IRR? Is the project acceptable using this model? Should Metal Werks replace the milling machine? Explain your decision. 25 14 15 16 0.2 17 Inputs 18 Project Life 19 Old Equip SVI 0) 20 Old Equip BV it-01 21 Old Equip Tax SV (t = 5) 22 Old Equip Econ SV (t + 5) 23 New Equip Cost 24 New Equip SV It 5) 25 Increase NWC 26 Op Cost Decrease 27 28 Tax Rate 29 WACO 30 31 Year 32 DepFactors 33 34 Nes Equip and out 5 Years $62,000 $75,000 $0 $0 $280,000 $25,000 $19.000 $80,000 per year Recovery Year 3-Year 5-Year 1 0.3333 2 0.4445 0:32 3 0.1481 0 192 4 0.0741 0.1152 5 0.1152 0.0576 7 8 7-Year 0.1429 0.2449 01749 0.1249 0.0893 0.0893 0.0892 0.0446 000 0.4 0.15 02 E Year 1 2 B $62,000 $75,000 $0 $0 $280,000 $25,000 $19,000 $80,000 per year G 3-Year 5-Year 0.3333 0.2 0.4445 0.32 0.1481 0.192 0.0741 0. 1152 0 1152 0.0576 3 19 Old Equip SV (t=0) 20 Old Equip BV (t = 0) 21 Old Equip Tax SV (t = 5) 22 Old Equip Econ SV (t = 5) 23 New Equip Cost 24 New Equip SV (t= 5) 25 Increase NWC 28 Op. Cost Decrease 27 28 Tax Rate 28 WACO 30 31 Year 32 Dep Factors H 7-Year 0.1429 0.2449 0.1749 0.1249 0.0893 0.0893 0.0892 0.0446 4 5 5 6 7 8 0.4 0.15 34 New Equip 35 Old Equip 36 NWC 37 38 Sales Rev 39 Cost 40 Dep (New) 41 Dep (Old) 42 Change in Dep 43 EBT 44 Tax 45 N 46 OCF AZ 00 C D E TI G A 40 Dep (New) 41 Dep (Old) 42 Change in Dep 43 EBT 44 Tax 45 NI 46 OCF 47 48 SV New (AT) 49 SV Old(AT) 50 Return NWC 51 52 FCF 53 64 55 Decision Why? 56 NPV 57 IRR 58 Payback 59 Overall Decision 80 Explain 61 62 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts