Question: 6. Suppose that your business is deciding between two different office buildings with unequal lives, and has a discount rate of 10%. Building one has

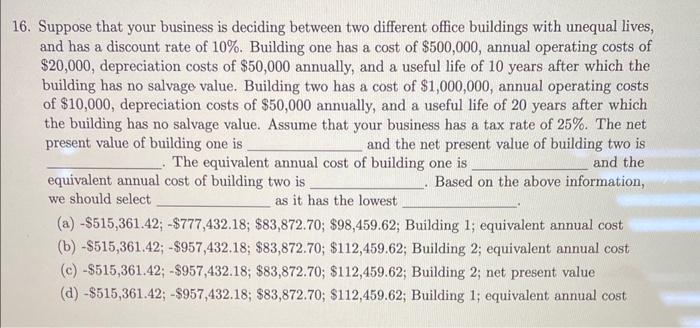

6. Suppose that your business is deciding between two different office buildings with unequal lives, and has a discount rate of 10%. Building one has a cost of $500,000, annual operating costs of $20,000, depreciation costs of $50,000 annually, and a useful life of 10 years after which the building has no salvage value. Building two has a cost of $1,000,000, annual operating costs of $10,000, depreciation costs of $50,000 annually, and a useful life of 20 years after which the building has no salvage value. Assume that your business has a tax rate of 25%. The net present value of building one is and the net present value of building two is The equivalent annual cost of building one is and the equivalent annual cost of building two is . Based on the above information, we should select as it has the lowest (a) $515,361.42;$777,432.18;$83,872.70;$98,459.62; Building 1 ; equivalent annual cost (b) $515,361.42;$957,432.18; $83,872.70;$112,459.62; Building 2 ; equivalent annual cost (c) $515,361.42;$957,432.18;$83,872.70;$112,459.62; Building 2 ; net present value (d) $515,361.42;$957,432.18;$83,872.70;$112,459.62; Building 1 ; equivalent annual cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts