Question: 6. The difference between the price at which a dealer is willing to buy and the price at which a dealer is willing to sell

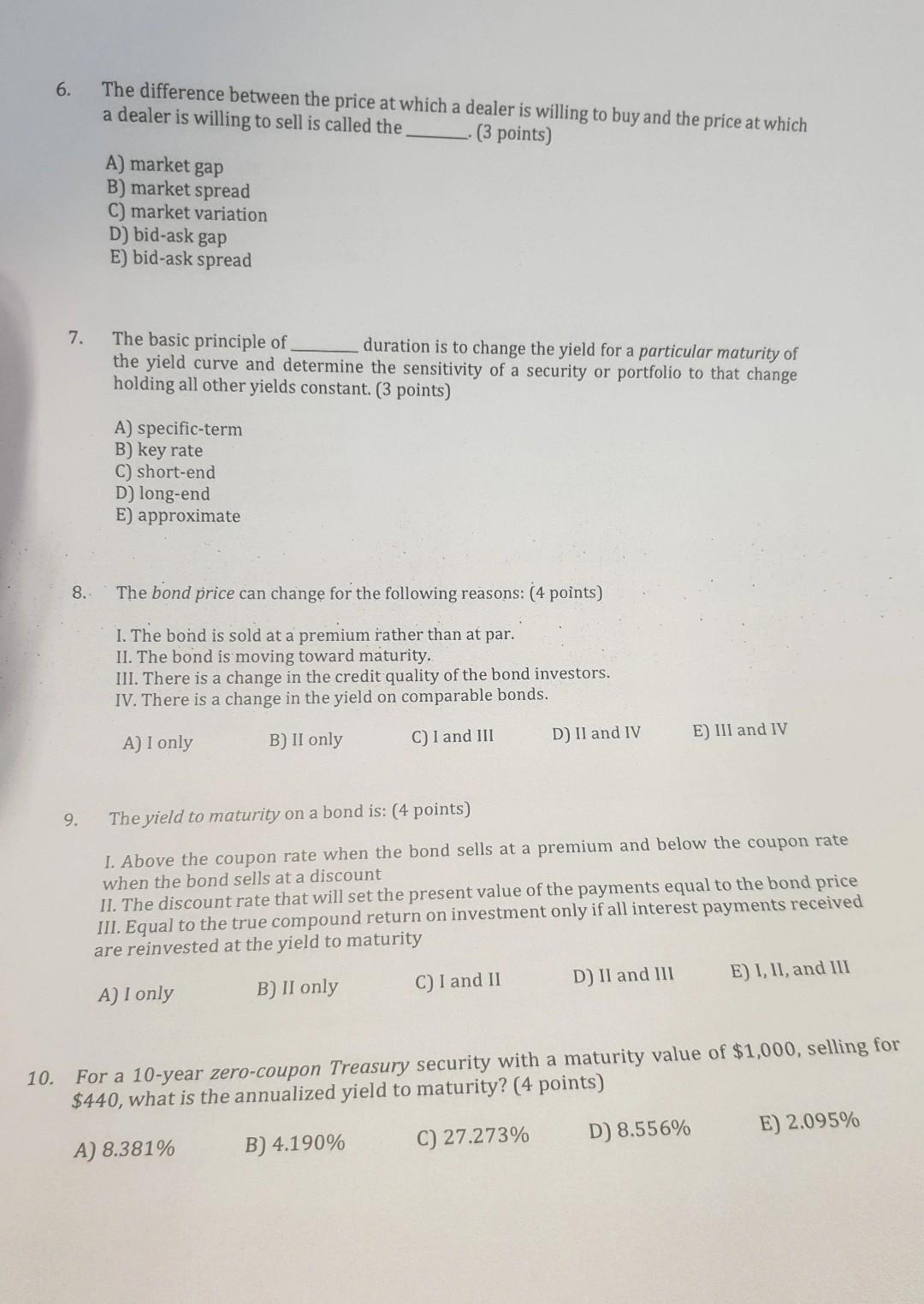

6. The difference between the price at which a dealer is willing to buy and the price at which a dealer is willing to sell is called the ( 3 points) A) market gap B) market spread C) market variation D) bid-ask gap E) bid-ask spread 7. The basic principle of duration is to change the yield for a particular maturity of the yield curve and determine the sensitivity of a security or portfolio to that change holding all other yields constant. (3 points) A) specific-term B) key rate C) short-end D) long-end E) approximate 8. The bond price can change for the following reasons: (4 points) I. The bond is sold at a premium rather than at par. II. The bond is moving toward maturity. III. There is a change in the credit quality of the bond investors. IV. There is a change in the yield on comparable bonds. A) I only B) II only C) I and III D) II and IV E) III and IV 9. The yield to maturity on a bond is: ( 4 points) I. Above the coupon rate when the bond sells at a premium and below the coupon rate when the bond sells at a discount II. The discount rate that will set the present value of the payments equal to the bond price III. Equal to the true compound return on investment only if all interest payments received are reinvested at the yield to maturity A) I only B) II only C) I and II D) II and III E) 1,11 , and III 10. For a 10-year zero-coupon Treasury security with a maturity value of $1,000, selling for $440, what is the annualized yield to maturity? ( 4 points) A) 8.381% B) 4.190% C) 27.273% D) 8.556% E) 2.095%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts