Question: 6. The probability that the loss from a portfolio will be greater than $10 million in one month is estimated to be 5% (that is,

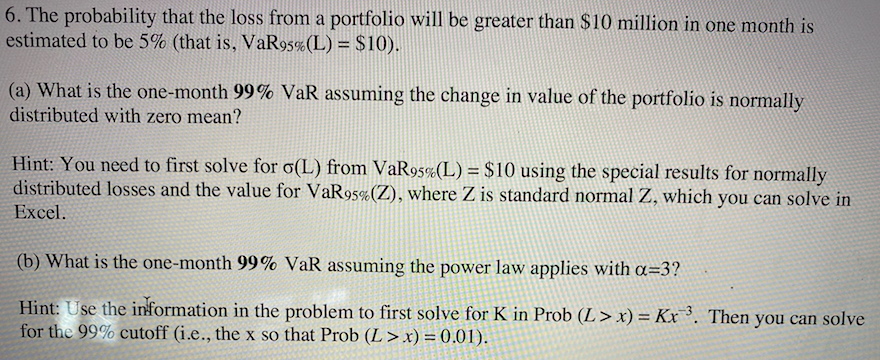

6. The probability that the loss from a portfolio will be greater than $10 million in one month is estimated to be 5% (that is, VaR95%(L) = $10). (a) What is the one-month 99% VaR assuming the change in value of the portfolio is normally distributed with zero mean? Hint: You need to first solve for o(L) from VaR95%(L) = $10 using the special results for normally distributed losses and the value for VaR95%(Z), where Z is standard normal Z, which you can solve in Excel. (b) What is the one-month 99% VaR assuming the power law applies with a=3? Hint: Use the information in the problem to first solve for K in Prob (L> x) = Kx-3. Then you can solve for the 99% cutoff (i.e., the x so that Prob (L > x) = 0.01). 6. The probability that the loss from a portfolio will be greater than $10 million in one month is estimated to be 5% (that is, VaR95%(L) = $10). (a) What is the one-month 99% VaR assuming the change in value of the portfolio is normally distributed with zero mean? Hint: You need to first solve for o(L) from VaR95%(L) = $10 using the special results for normally distributed losses and the value for VaR95%(Z), where Z is standard normal Z, which you can solve in Excel. (b) What is the one-month 99% VaR assuming the power law applies with a=3? Hint: Use the information in the problem to first solve for K in Prob (L> x) = Kx-3. Then you can solve for the 99% cutoff (i.e., the x so that Prob (L > x) = 0.01)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts