Question: Lest edit was 2 minutes ago 12 + BILAG EQ. S1E IEEE 1 2 I recommend the practice problems 12.1, 12.3-12.6, 12.12 Required Problems 1.

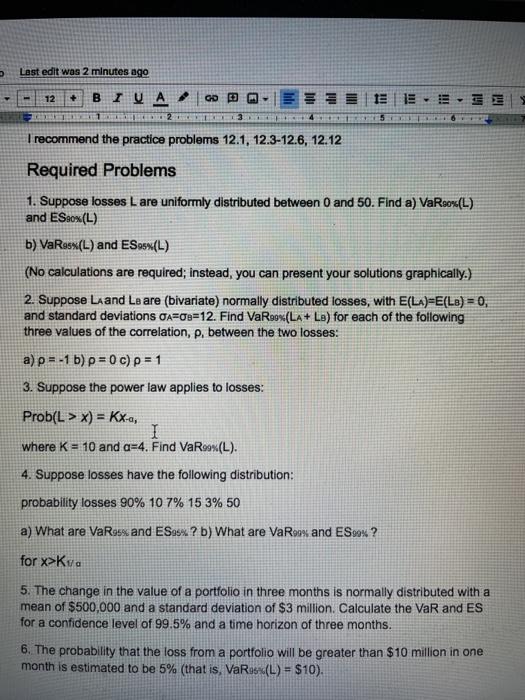

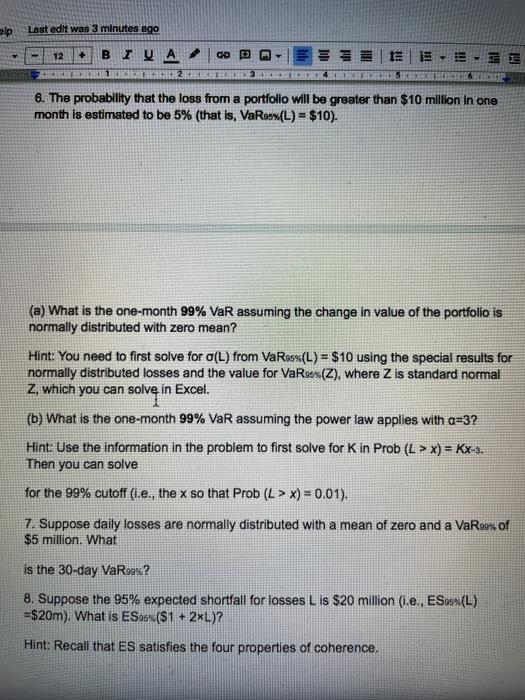

Lest edit was 2 minutes ago 12 + BILAG EQ. S1E IEEE 1 2 I recommend the practice problems 12.1, 12.3-12.6, 12.12 Required Problems 1. Suppose losses L are uniformly distributed between 0 and 50. Find a) VaR80%(L) and ESeox (L) b) VaRox(L) and ES95%(L) (No calculations are required; instead, you can present your solutions graphically.) 2. Suppose Laand La are (bivariate) normally distributed losses, with E(LA)=E(La) = 0, and standard deviations da=08=12. Find VaRoos (LA + Le) for each of the following three values of the correlation, p, between the two losses: a) p = -1 b) p = 0 c) p = 1 3. Suppose the power law applies to losses: Prob(L > x) = KX-a, I where K = 10 and a=4. Find VaR99%(L). 4. Suppose losses have the following distribution: probability losses 90% 10 7% 15 3% 50 a) What are VaR954 and ESas? b) What are VaR and Sox? for x>Kua 5. The change in the value of a portfolio in three months is normally distributed with a mean of $500,000 and a standard deviation of $3 million. Calculate the VaR and ES for a confidence level of 99.5% and a time horizon of three months. 6. The probability that the loss from a portfolio will be greater than $10 million in one month is estimated to be 5% (that is, VaR s(L) = $10). elp Last edit was 3 minutes ago 12 + B . OD 2 | 15 | EE. 12 4TV 5 X 6 6. The probability that the loss from a portfolio will be greater than $10 million in one month is estimated to be 5% (that is, VaRos(L) = $10). (a) What is the one-month 99% VaR assuming the change in value of the portfolio is normally distributed with zero mean? Hint: You need to first solve for o(L) from VaR5%(L) = $10 using the special results for normally distributed losses and the value for VaRos*(Z), where Z is standard normal Z which you can solve in Excel. (b) What is the one-month 99% VaR assuming the power law applies with a=3? Hint: Use the information in the problem to first solve for K in Prob (L > x) = KX-3. Then you can solve for the 99% cutoff (i.e., the x so that Prob (L > x) = 0.01). 7. Suppose daily losses are normally distributed with a mean of zero and a VaRex of $5 million. What is the 30-day VaRox? 8. Suppose the 95% expected shortfall for losses L is $20 million (1.e., ES25(L) =$20m). What is ES96($1 + 2xL)? Hint: Recall that ES satisfies the four properties of coherence. Lest edit was 2 minutes ago 12 + BILAG EQ. S1E IEEE 1 2 I recommend the practice problems 12.1, 12.3-12.6, 12.12 Required Problems 1. Suppose losses L are uniformly distributed between 0 and 50. Find a) VaR80%(L) and ESeox (L) b) VaRox(L) and ES95%(L) (No calculations are required; instead, you can present your solutions graphically.) 2. Suppose Laand La are (bivariate) normally distributed losses, with E(LA)=E(La) = 0, and standard deviations da=08=12. Find VaRoos (LA + Le) for each of the following three values of the correlation, p, between the two losses: a) p = -1 b) p = 0 c) p = 1 3. Suppose the power law applies to losses: Prob(L > x) = KX-a, I where K = 10 and a=4. Find VaR99%(L). 4. Suppose losses have the following distribution: probability losses 90% 10 7% 15 3% 50 a) What are VaR954 and ESas? b) What are VaR and Sox? for x>Kua 5. The change in the value of a portfolio in three months is normally distributed with a mean of $500,000 and a standard deviation of $3 million. Calculate the VaR and ES for a confidence level of 99.5% and a time horizon of three months. 6. The probability that the loss from a portfolio will be greater than $10 million in one month is estimated to be 5% (that is, VaR s(L) = $10). elp Last edit was 3 minutes ago 12 + B . OD 2 | 15 | EE. 12 4TV 5 X 6 6. The probability that the loss from a portfolio will be greater than $10 million in one month is estimated to be 5% (that is, VaRos(L) = $10). (a) What is the one-month 99% VaR assuming the change in value of the portfolio is normally distributed with zero mean? Hint: You need to first solve for o(L) from VaR5%(L) = $10 using the special results for normally distributed losses and the value for VaRos*(Z), where Z is standard normal Z which you can solve in Excel. (b) What is the one-month 99% VaR assuming the power law applies with a=3? Hint: Use the information in the problem to first solve for K in Prob (L > x) = KX-3. Then you can solve for the 99% cutoff (i.e., the x so that Prob (L > x) = 0.01). 7. Suppose daily losses are normally distributed with a mean of zero and a VaRex of $5 million. What is the 30-day VaRox? 8. Suppose the 95% expected shortfall for losses L is $20 million (1.e., ES25(L) =$20m). What is ES96($1 + 2xL)? Hint: Recall that ES satisfies the four properties of coherence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts