Question: 6. This is a problem addressing covered interest parity (CIP) and uncovered interest parity (UIP). Suppose the interest rate in Israel on a 180-day government

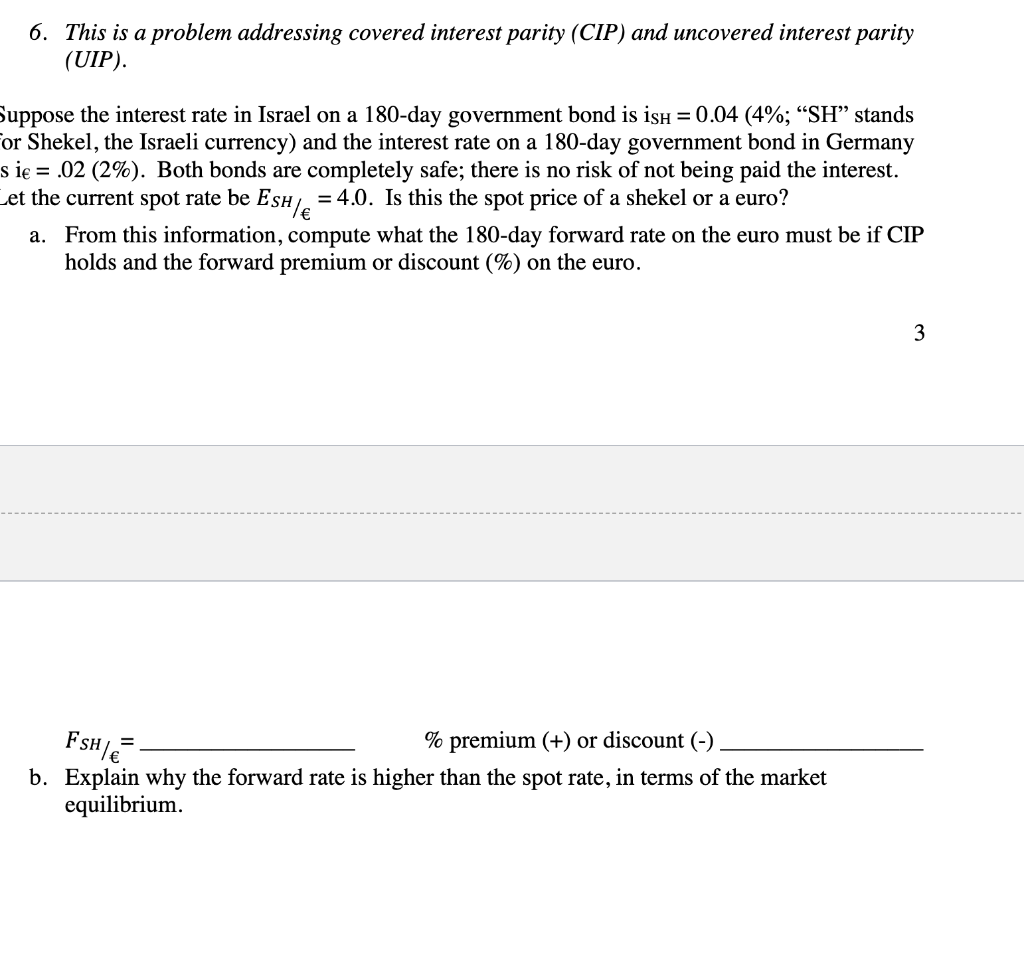

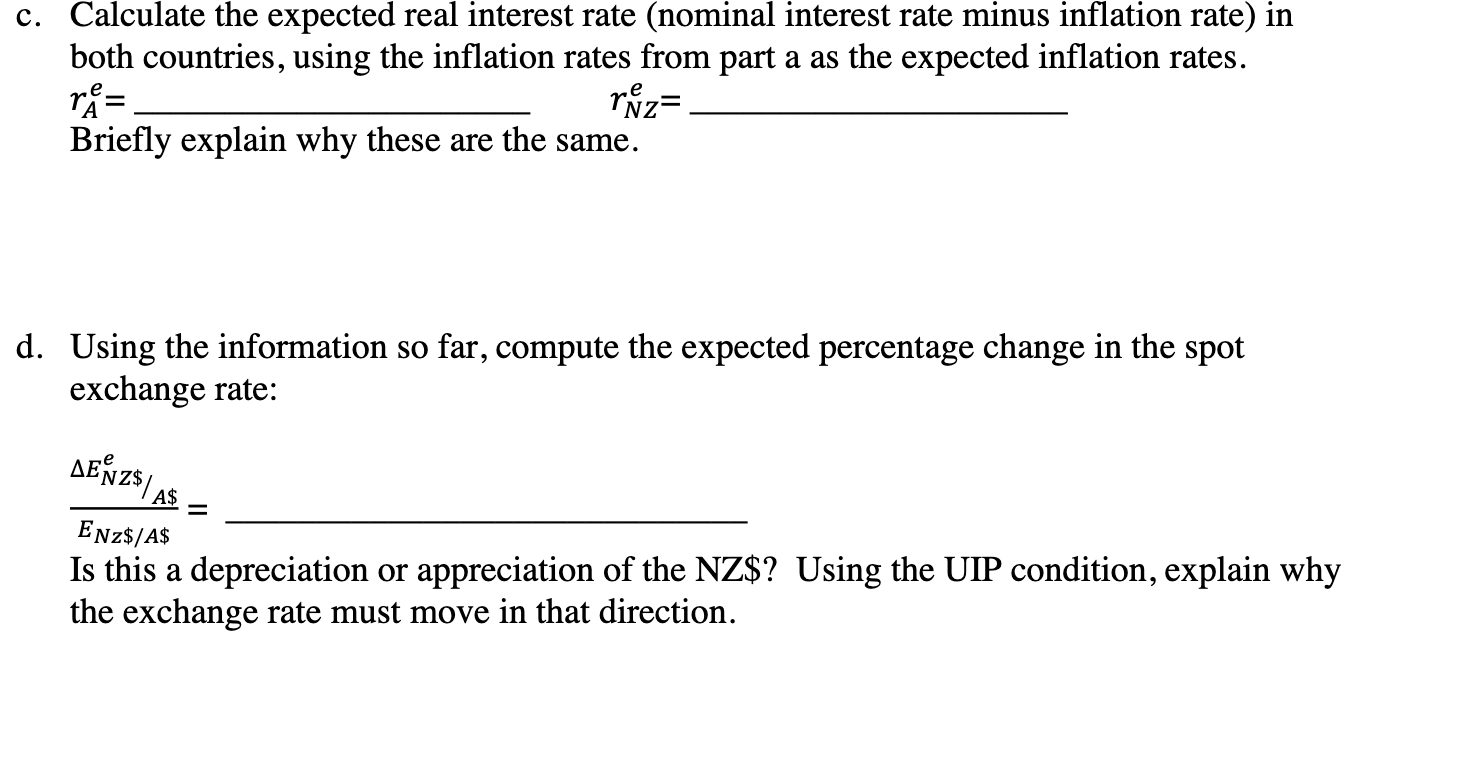

6. This is a problem addressing covered interest parity (CIP) and uncovered interest parity (UIP). Suppose the interest rate in Israel on a 180-day government bond is ish = 0.04 (4%; SH stands For Shekel, the Israeli currency) and the interest rate on a 180-day government bond in Germany sie = .02 (2%). Both bonds are completely safe; there is no risk of not being paid the interest. Let the current spot rate be Es = 4.0. Is this the spot price of a shekel or a euro? a. From this information, compute what the 180-day forward rate on the euro must be if CIP holds and the forward premium or discount (%) on the euro. Fshl % premium (+) or discount (-). b. Explain why the forward rate is higher than the spot rate, in terms of the market equilibrium. c. Calculate the expected real interest rate (nominal interest rate minus inflation rate) in both countries, using the inflation rates from part a as the expected inflation rates. rer - rz= Briefly explain why these are the same. d. Using the information so far, compute the expected percentage change in the spot exchange rate: DENZ$ / A$ = Enz$/A$ Is this a depreciation or appreciation of the NZ$? Using the UIP condition, explain why the exchange rate must move in that direction. 6. This is a problem addressing covered interest parity (CIP) and uncovered interest parity (UIP). Suppose the interest rate in Israel on a 180-day government bond is ish = 0.04 (4%; SH stands For Shekel, the Israeli currency) and the interest rate on a 180-day government bond in Germany sie = .02 (2%). Both bonds are completely safe; there is no risk of not being paid the interest. Let the current spot rate be Es = 4.0. Is this the spot price of a shekel or a euro? a. From this information, compute what the 180-day forward rate on the euro must be if CIP holds and the forward premium or discount (%) on the euro. Fshl % premium (+) or discount (-). b. Explain why the forward rate is higher than the spot rate, in terms of the market equilibrium. c. Calculate the expected real interest rate (nominal interest rate minus inflation rate) in both countries, using the inflation rates from part a as the expected inflation rates. rer - rz= Briefly explain why these are the same. d. Using the information so far, compute the expected percentage change in the spot exchange rate: DENZ$ / A$ = Enz$/A$ Is this a depreciation or appreciation of the NZ$? Using the UIP condition, explain why the exchange rate must move in that direction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts