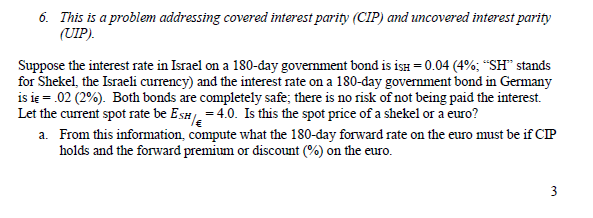

Question: 6. This is a problem addressing covered interest parity (CIP) and uncovered interest parin (UIP). Suppose the interest rate in Israel on a 180-day government

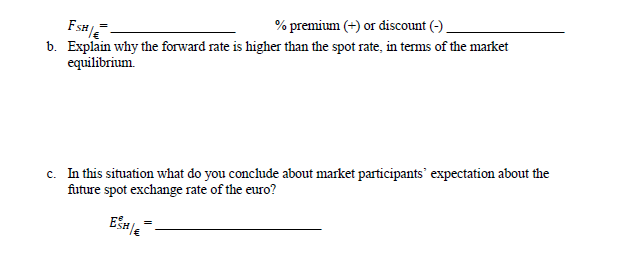

6. This is a problem addressing covered interest parity (CIP) and uncovered interest parin (UIP). Suppose the interest rate in Israel on a 180-day government bond is 15H-0.04 (4%; "SH', stands for Shekel, the Israeli currency) and the interest rate on a 180-day government bond in Germany is ie = .02 (2%). Both bonds are completely safe, there is no risk of not being paid the interest. Let the current spot rate be ESHE-40 Is this the spot price of a shekel or a euro? From this information, compute what the 180-day forward rate on the euro must be if CIP holds and the forward a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts