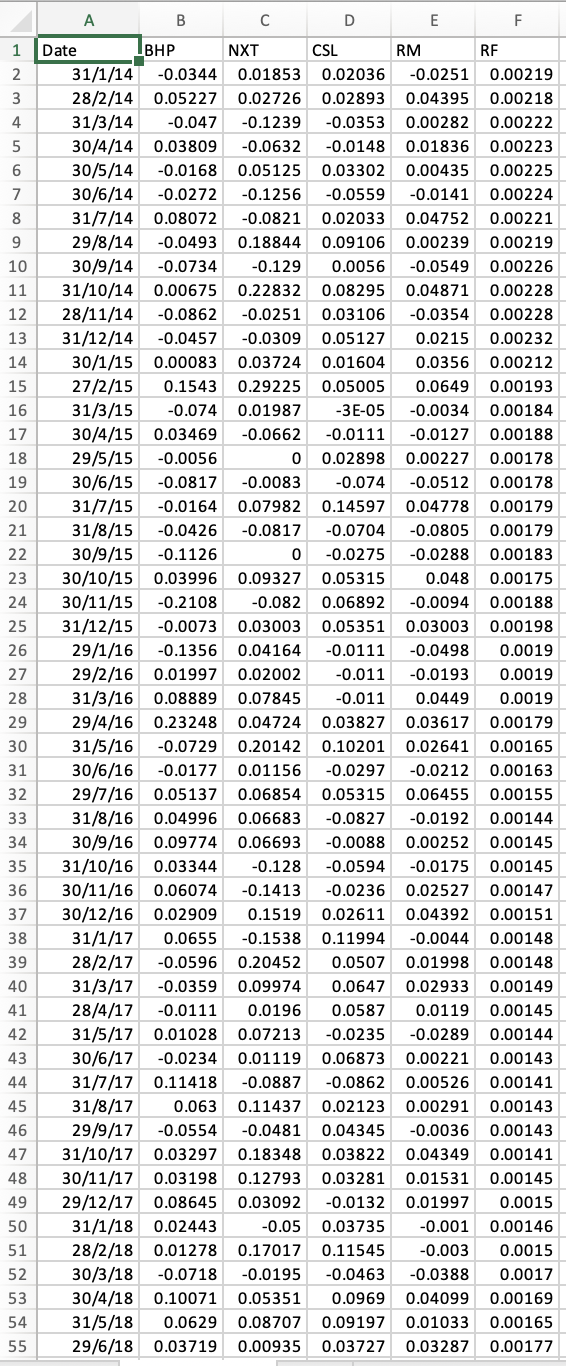

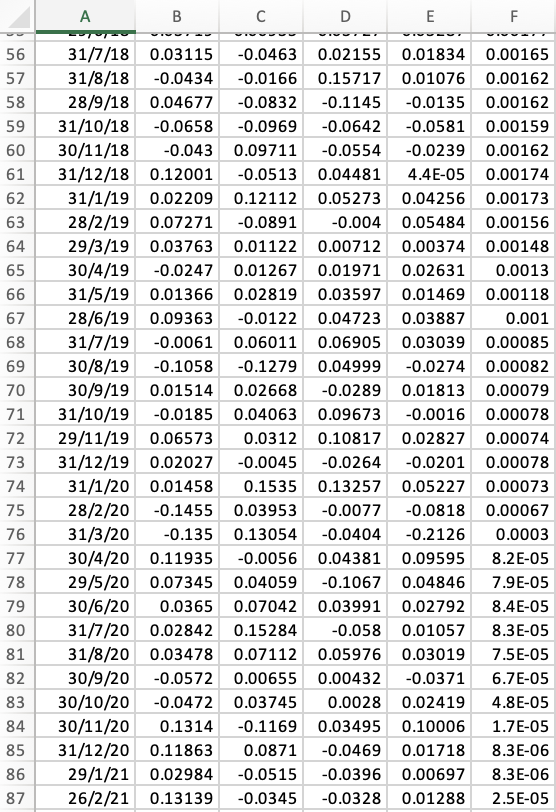

Question: 6. Use the data in the Tutorial 4.xslx spreadsheet on Moodle. It contains the returns for BHP, NXT and CSL, the market (RM) and the

6. Use the data in the Tutorial 4.xslx spreadsheet on Moodle. It contains the returns for BHP, NXT and CSL, the market (RM) and the risk-free asset (RF).

a) Estimate the alpha, beta and idiosyncratic risk for BHP and NXT. Discuss and compare the differences between the two stocks.

b) Estimate the betas for BHP, NXT and CSL for two different time periods: Jan 2014 to Dec 2017 and Jan 2018 to Feb 2021. (Hint: use the SLOPE function in Excel). How stable are the betas for each stock over these sub-periods? Discuss with reference to the companies and the economy.

c) Based on your analysis, which stock would you expect to perform the best during an economic downturn?

\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts