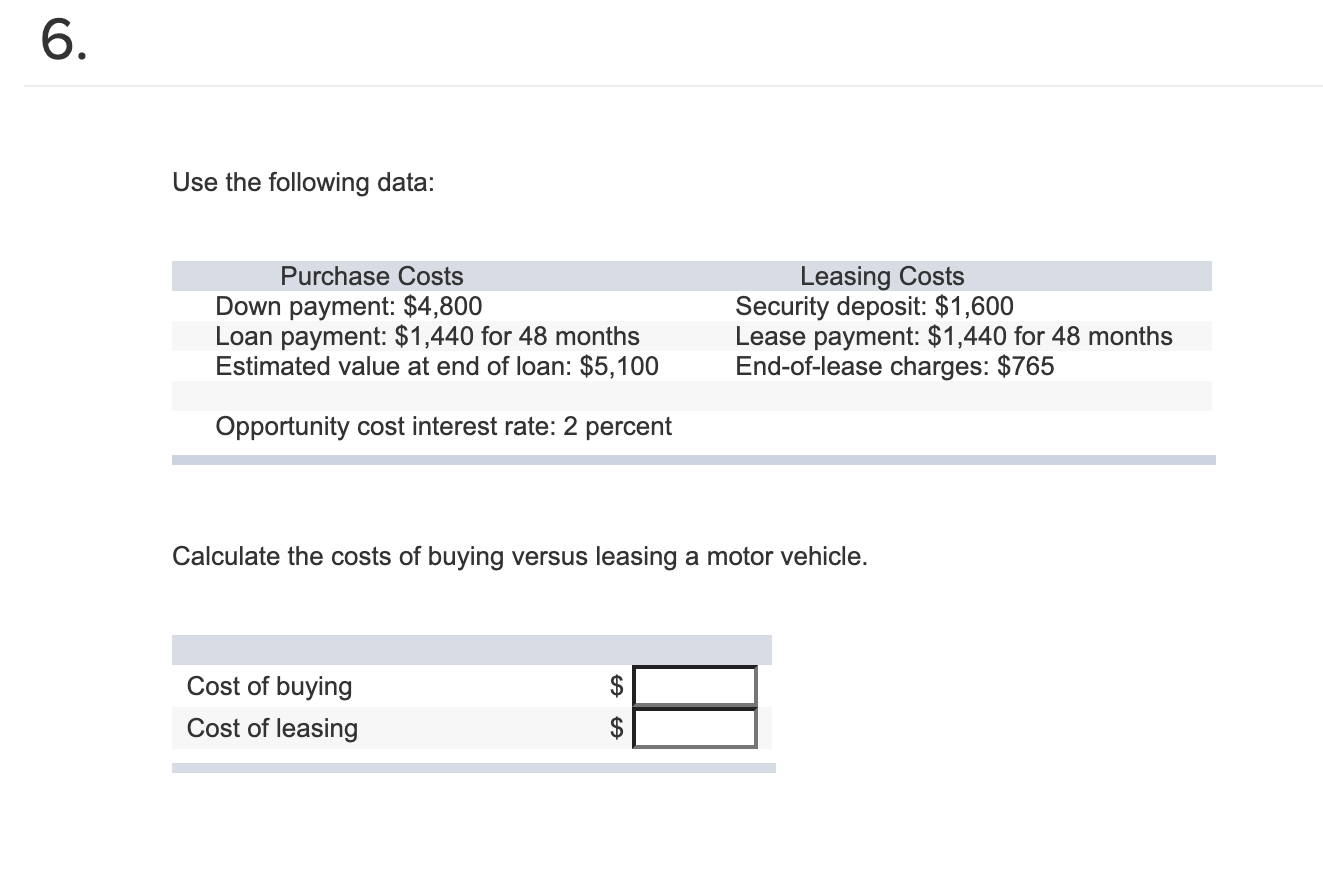

Question: 6. Use the following data: Purchase Costs Down payment: $4,800 Loan payment: $1,440 for 48 months Estimated value at end of loan: $5,100 Leasing Costs

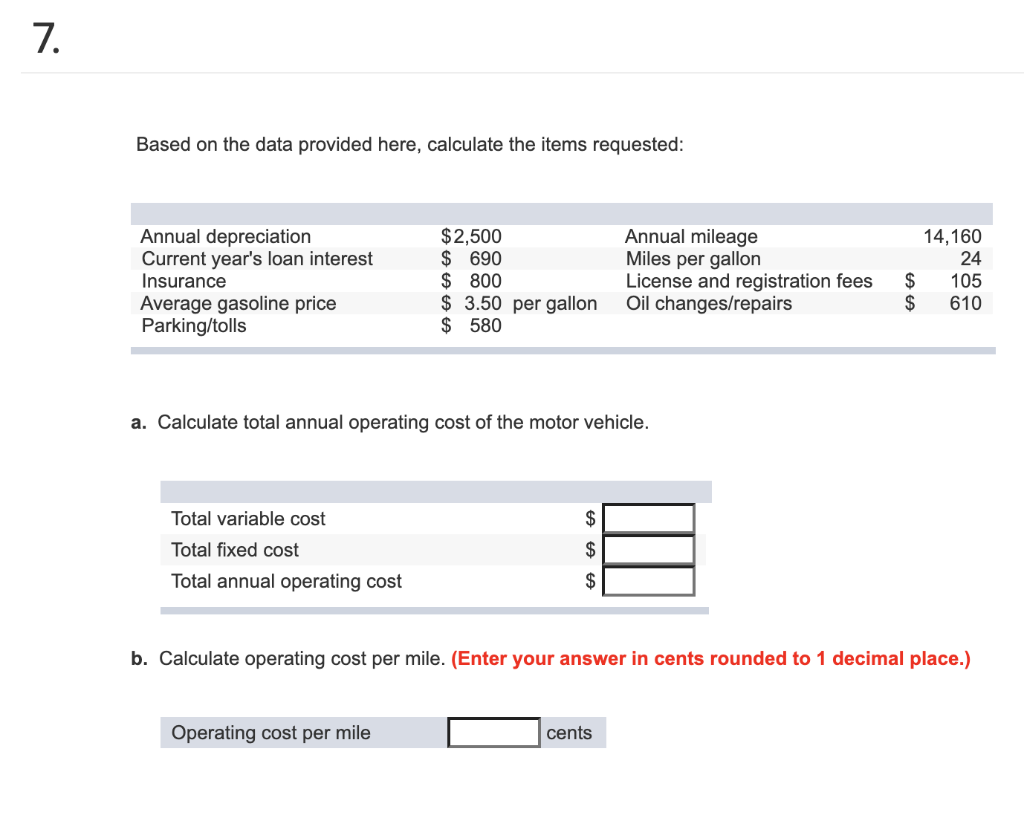

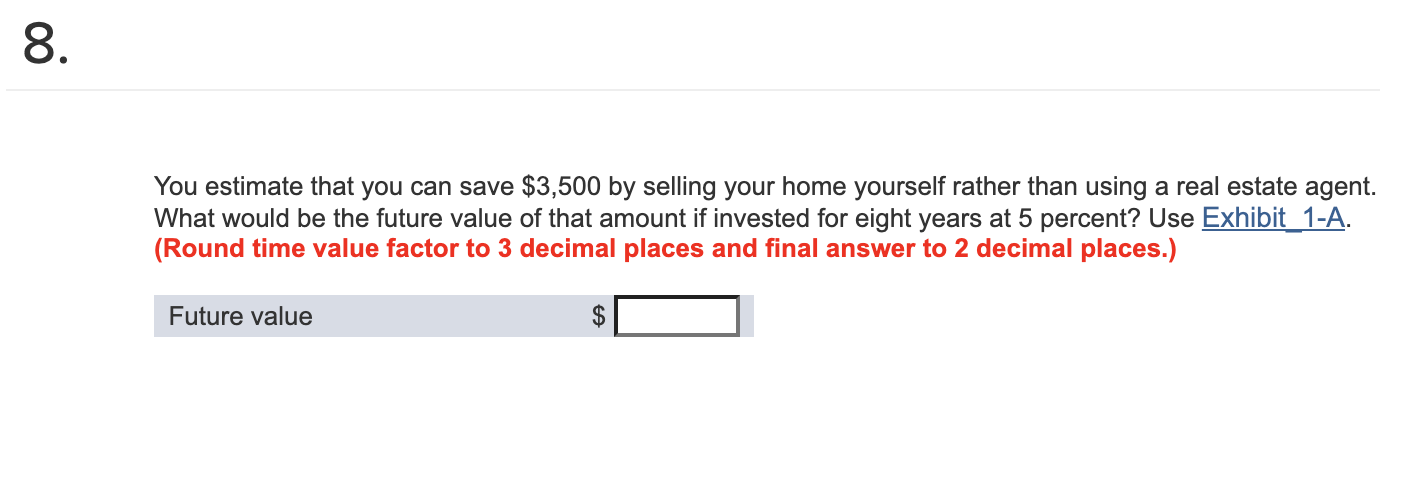

6. Use the following data: Purchase Costs Down payment: $4,800 Loan payment: $1,440 for 48 months Estimated value at end of loan: $5,100 Leasing Costs Security deposit: $1,600 Lease payment: $1,440 for 48 months End-of-lease charges: $765 Opportunity cost interest rate: 2 percent Calculate the costs of buying versus leasing a motor vehicle. Cost of buying Cost of leasing A A 7. Based on the data provided here, calculate the items requested: Annual depreciation Current year's loan interest Insurance Average gasoline price Parking/tolls $2,500 $ 690 $ 800 $ 3.50 per gallon $ 580 Annual mileage Miles per gallon License and registration fees Oil changes/repairs 14,160 24 $ 105 $ 610 a. Calculate total annual operating cost of the motor vehicle. $ Total variable cost Total fixed cost Total annual operating cost | 0 0 . b. Calculate operating cost per mile. (Enter your answer in cents rounded to 1 decimal place.) Operating cost per mile cents 8. You estimate that you can save $3,500 by selling your home yourself rather than using a real estate agent. What would be the future value of that amount if invested for eight years at 5 percent? Use Exhibit_1-A. (Round time value factor to 3 decimal places and final answer to 2 decimal places.) Future value $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts