Takamatsu Sports is a Japanese sporting goods company based in Osaka, Japan, that manufactures and sells tennis

Question:

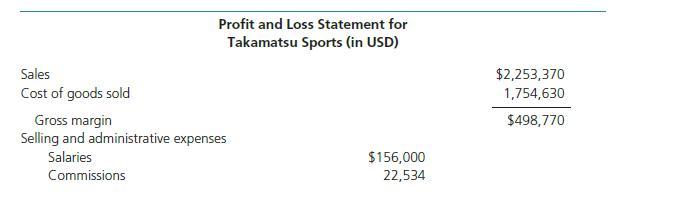

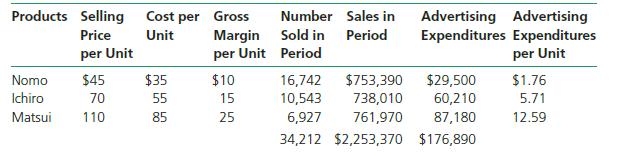

Takamatsu Sports is a Japanese sporting goods company based in Osaka, Japan, that manufactures and sells tennis equipment. It sells three different tennis racquets: the Nomo, the Ichiro, and the Matsui. The company experienced a loss last year for the first time, and founder and CEO Hiroshi Takamatsu is interested in analyzing the company’s financial data to determine a cause for the loss. Takamatsu’s profit and loss statement for last year is as follows:

Takamatsu Sports has three sales representatives: Daisuke Chimura, Akihide Fujita, and Yoko Ota. Mr. Chimura and Mr. Fujita, both men, have been with the company for years and have successful sales records. However, the newest sales representative, Ms. Ota, is female and yet unproven, and the decision to hire her was a big change from traditional Japanese culture, because in the past it was rare for women to hold such positions. Mr. Takamatsu felt when hiring her that she was highly qualified, but he was concerned that she would face a challenge in communicating to customers because the customers might be uncomfortable working with a woman. In fact, early indications are that Ms. Ota is not making as many sales calls as the other two representatives.

This troubles Mr. Takamatsu because at Takamatsu Sports, and in Japan in general, selling is based on a relationship-selling model, where relationships between seller and customer are paramount and may be built for months before an overture of buying products even is made.

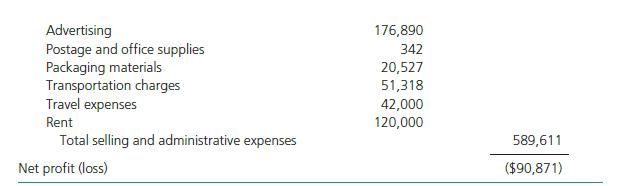

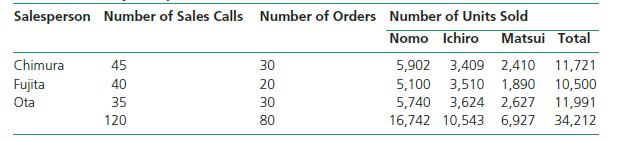

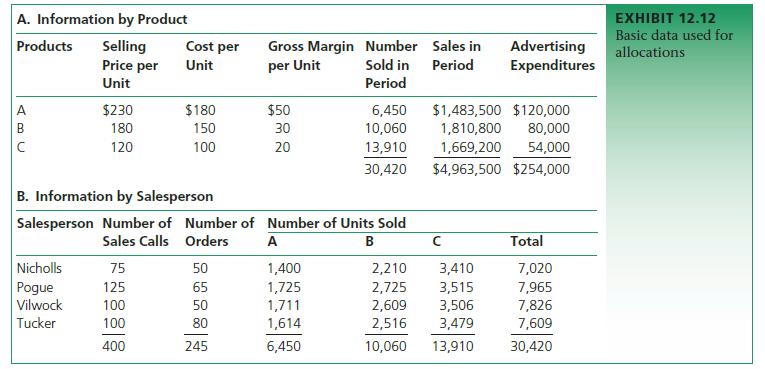

Mr. Takamatsu decided to do a cost analysis with the purpose of determining the profitability of the three sales representatives. He then allocated natural accounts to functional accounts as follows:

He then gathered the following sales data to use in the profitability analysis:

A. Information by Product

B. Information by Salesperson

Mr. Takamatsu also determined the following data for making the cost allocations:

• Each salesperson was paid a $40,000 salary with a 1 percent commission on what was sold.

• Each salesperson was allotted an annual travel expense budget of $14,000, which was fully used by each salesperson.

• Advertising cost was allotted by the number of units sold by each salesperson.

• Packaging and shipping for the warehousing cost is $0.60 per unit sold.

• Order processing cost is $.01 per unit sold.

• Transportation cost is $1.50 per unit sold.

Mr. Takamatsu has now come to you, his trusted managerial accountant, with the preceding data and has asked you to perform the profitability analysis for the three sales representatives.

Questions

1. Develop a profitability analysis by salesperson based on the model of Exhibit 12.12 in the textbook.

2. Who is the most profitable sales representative? The least? Are Mr. Takamatsu’s concerns about Ms. Ota’s performance valid?

3. Based on your analysis, what recommendation(s) can you give to Mr. Takamatsu to return his company to profitability?

Step by Step Answer:

Sales Force Management Leadership Innovation Technology

ISBN: 9781138951723

12th Edition

Authors: Mark W. Johnston, Greg W. Marshall