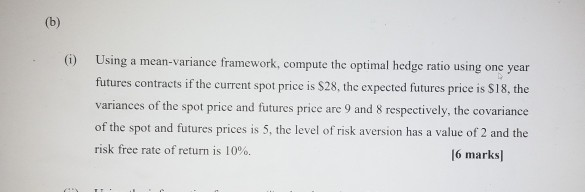

Question: 6 Using a mean-variance framework, compute the optimal hedge ratio using one year n-variance framework, compute the optimal hedge ratio using onc year futures contracts

6 Using a mean-variance framework, compute the optimal hedge ratio using one year n-variance framework, compute the optimal hedge ratio using onc year futures contracts if the current spot price is S28, the expected futures price is S18, the variances of the spot price and futures price are 9 and 8 respectively, the covariance of the spot and futures prices is 5, the level of risk aversion has a value of 2 and the risk free rate of return is 10%. 6 marks 6 Using a mean-variance framework, compute the optimal hedge ratio using one year n-variance framework, compute the optimal hedge ratio using onc year futures contracts if the current spot price is S28, the expected futures price is S18, the variances of the spot price and futures price are 9 and 8 respectively, the covariance of the spot and futures prices is 5, the level of risk aversion has a value of 2 and the risk free rate of return is 10%. 6 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts