Question: help me pls :( (a) Using a mean-variance framework, compute the optimal hedge ratio of an oil producer using two year futures contracts on oil,

help me pls :(

help me pls :(

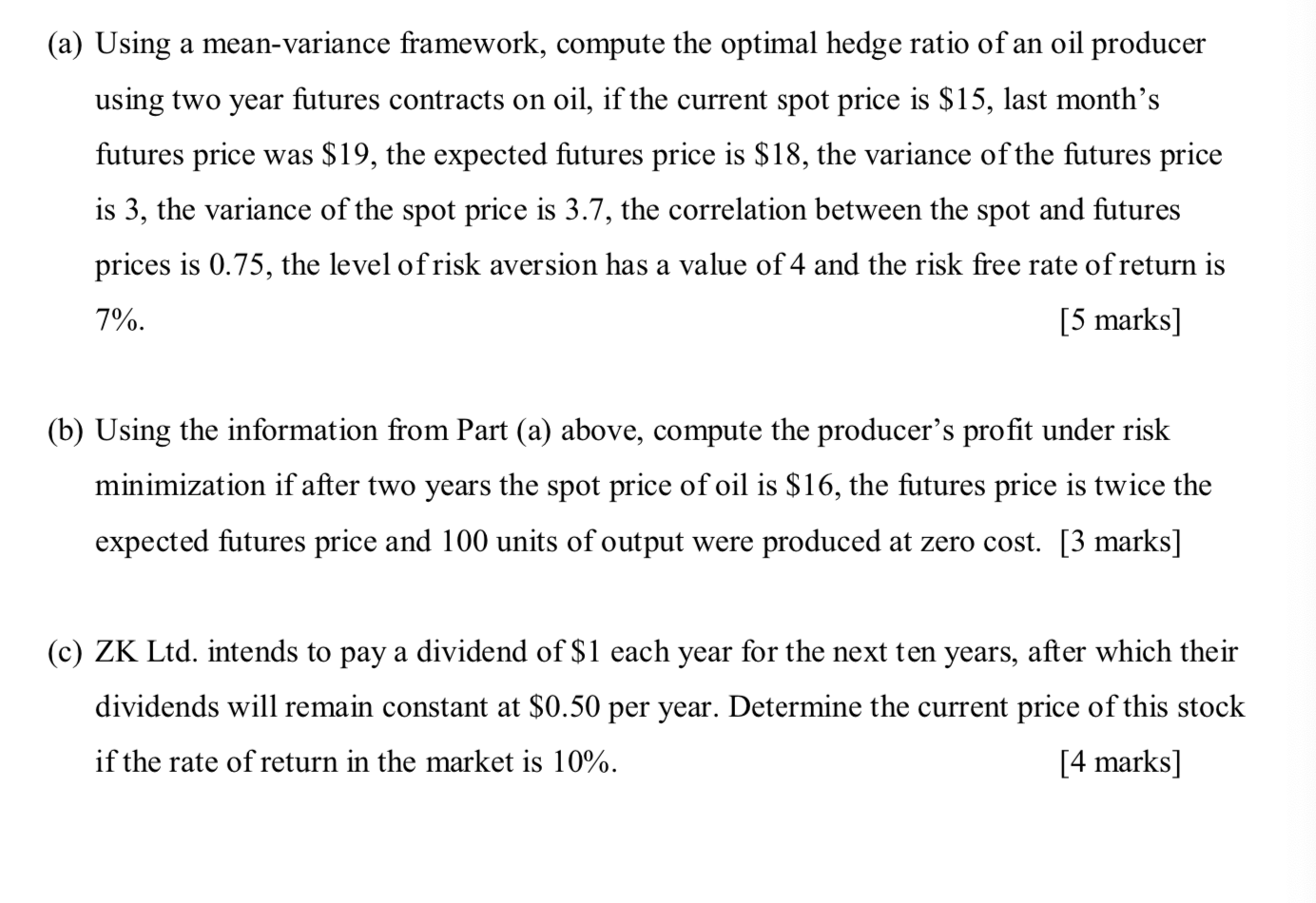

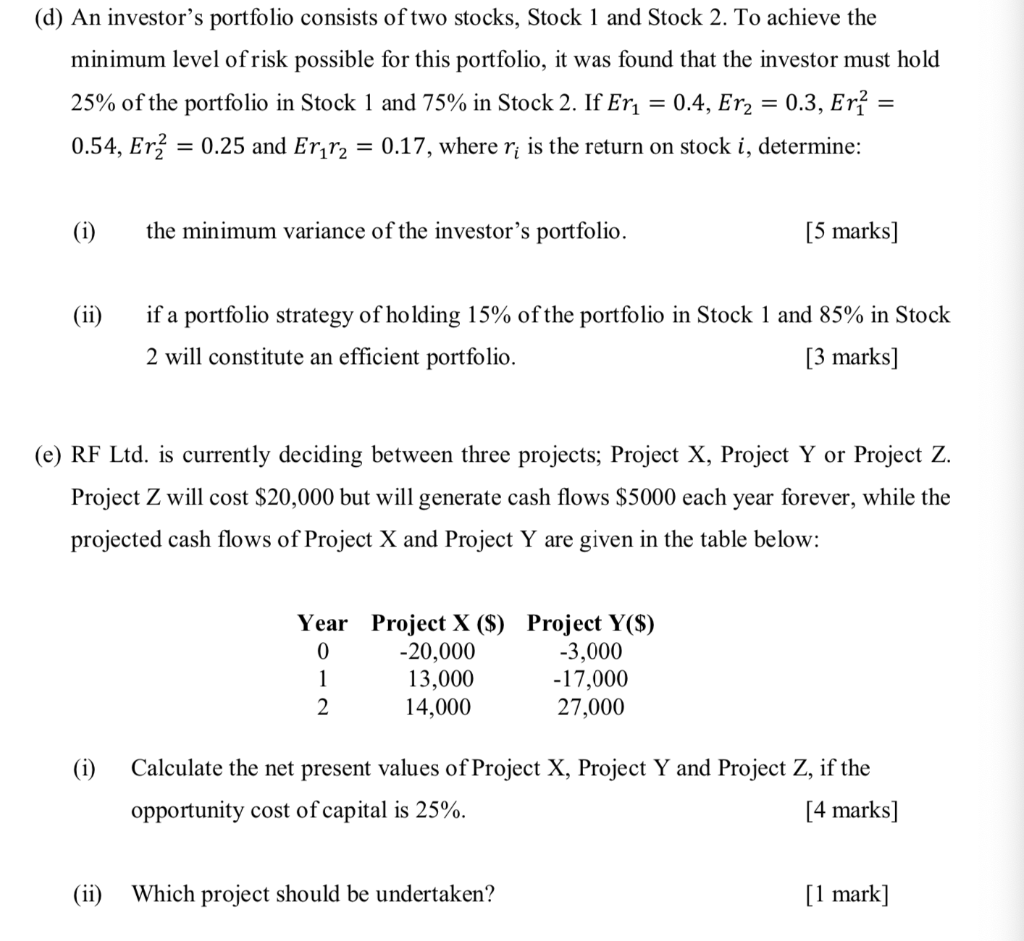

(a) Using a mean-variance framework, compute the optimal hedge ratio of an oil producer using two year futures contracts on oil, if the current spot price is $15, last month's futures price was $19, the expected futures price is $18, the variance of the futures price is 3, the variance of the spot price is 3.7, the correlation between the spot and futures prices is 0.75, the level of risk aversion has a value of 4 and the risk free rate of return is 7%. [5 marks] (b) Using the information from Part (a) above, compute the producer's profit under risk minimization if after two years the spot price of oil is $16, the futures price is twice the expected futures price and 100 units of output were produced at zero cost. [3 marks] (c) ZK Ltd. intends to pay a dividend of $1 each year for the next ten years, after which their dividends will remain constant at $0.50 per year. Determine the current price of this stock if the rate of return in the market is 10%. [4 marks] (d) An investor's portfolio consists of two stocks, Stock 1 and Stock 2. To achieve the minimum level of risk possible for this portfolio, it was found that the investor must hold 25% of the portfolio in Stock 1 and 75% in Stock 2. If Er = 0.4, Er2 = 0.3, Er- 0.54, Er2 = 0.25 and Erra 0.17, where r; is the return on stock i, determine: (i) the minimum variance of the investor's portfolio. [5 marks] (ii) if a portfolio strategy of holding 15% of the portfolio in Stock 1 and 85% in Stock 2 will constitute an efficient portfolio. [3 marks] (e) RF Ltd. is currently deciding between three projects; Project X, Project Y or Project Z. Project Z will cost $20,000 but will generate cash flows $5000 each year forever, while the projected cash flows of Project X and Project Y are given in the table below: Year Project X ($) Project Y($) 0 -20,000 -3,000 13,000 -17,000 2 14,000 27,000 1 (i) Calculate the net present values of Project X, Project Y and Project Z, if the opportunity cost of capital is 25%. [4 marks] Which project should be undertaken? [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts