Question: 6. What is the difference between a growth stock and a value stock? a) Growth stocks are more likely to pay dividends, while value stocks

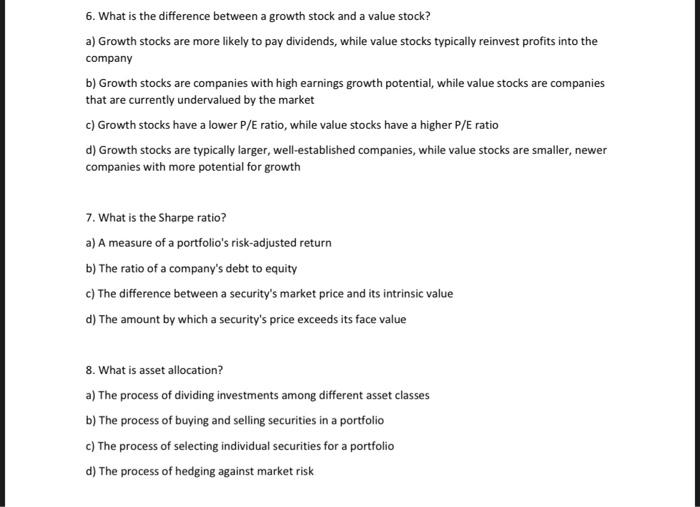

6. What is the difference between a growth stock and a value stock? a) Growth stocks are more likely to pay dividends, while value stocks typically reinvest profits into the company b) Growth stocks are companies with high earnings growth potential, while value stocks are companies that are currently undervalued by the market c) Growth stocks have a lower P/E ratio, while value stocks have a higher P/E ratio d) Growth stocks are typically larger, well-established companies, while value stocks are smaller, newer companies with more potential for growth 7. What is the Sharpe ratio? a) A measure of a portfolio's risk-adjusted return b) The ratio of a company's debt to equity c) The difference between a security's market price and its intrinsic value d) The amount by which a security's price exceeds its face value 8. What is asset allocation? a) The process of dividing investments among different asset classes b) The process of buying and selling securities in a portfolio c) The process of selecting individual securities for a portfolio d) The process of hedging against market risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts