Question: 6. Which asset has positive convexity for a large decrease in interest rates? A standard Bonds B. callable Bonds C. corporate Bonds with bad ratings

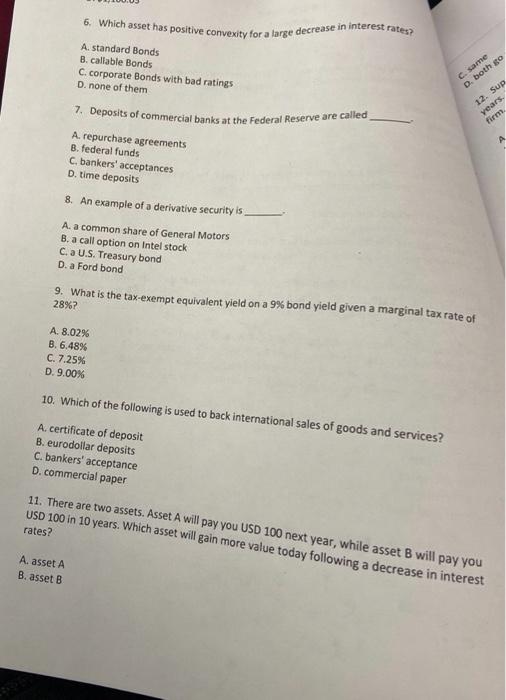

6. Which asset has positive convexity for a large decrease in interest rates? A standard Bonds B. callable Bonds C. corporate Bonds with bad ratings D. none of them C same D. both go 7. Deposits of commercial banks at the Federal Reserve are called 12. Sup years. firm A.repurchase agreements B. federal funds C. bankers' acceptances D. time deposits 8. An example of a derivative security is A. a common share of General Motors B. a call option on Intel stock C. a U.S. Treasury bond D. a Ford bond 9. What is the tax-exempt equivalent yield on a 9% bond yield given a marginal tax rate of 28%? A. 8.02% B. 6.48% C. 7.25% D. 9.00% 10. Which of the following is used to back international sales of goods and services? A. certificate of deposit B. eurodollar deposits C. bankers' acceptance D.commercial paper 11. There are two assets. Asset A will pay you USD 100 next year, while asset B will pay you USD 100 in 10 years. Which asset will gain more value today following a decrease in interest rates? A. asset A B. asset B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts