Question: 6. Within-firm risk and beta risk: Understanding risks that affect projects and the impact of risk conaideration Garcia Real Estate is involved in commercial feal

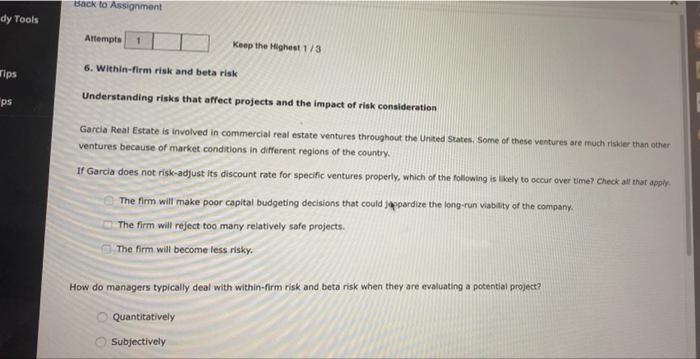

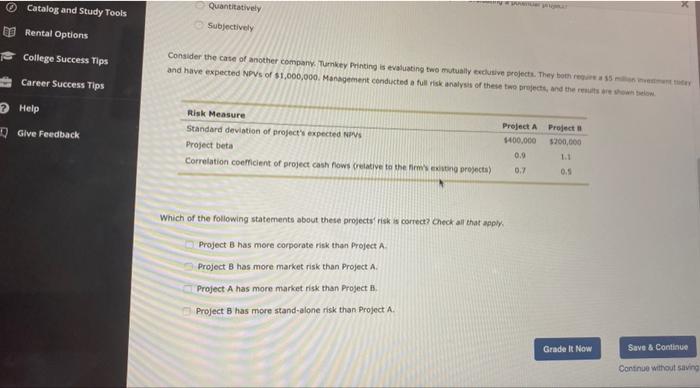

6. Within-firm risk and beta risk: Understanding risks that affect projects and the impact of risk conaideration Garcia Real Estate is involved in commercial feal estate ventures throughout the United States. Some of these ventures are much riskler than other ventures because of market conditions in different regions of the country. If Garcia does not risk-adjust its discount rate for specific ventures properly, which of the following is ikely to occur over time? check all ehat appif. The firm will make poor capital budgeting decisions that could joppardize the long-run viabity of the company. The firm will reject too many relatively safe projects. The firm will become less risky. How do managers typically deal with within-firm risk and beta risk when they are evaluating a potential project? Quantitatively Subjectively Quantitatively Sebjectively Which of the following statements about these projects' risk is correcti check all that apply. Project B has more corporate risk than Project A. Project B has more market risk than Project A. Project A has more market risk than Project B. Project 8 has more stand-alone risk than Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts