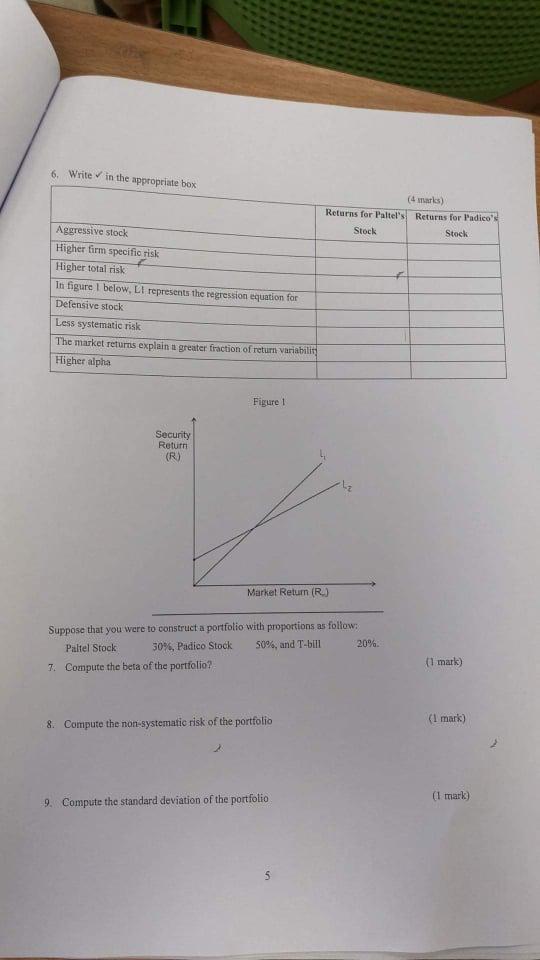

Question: 6. Write in the appropriate box (4 marks) Returns for Paltel's Returns for Padico's Stock Stock Aggressive stock Higher firm specific risk Higher total risk

6. Write in the appropriate box (4 marks) Returns for Paltel's Returns for Padico's Stock Stock Aggressive stock Higher firm specific risk Higher total risk In figure I below, Li represents the regression equation for Defensive stock Less systematic risk The market returns explain a greater fraction of return variability Higher alpha + Figure 1 Security Return (R) Market Return (R) Suppose that you were to construct a portfolio with proportions as follows: Paltel Stock 30%, Padico Stock 50%, and T-bill 20%. 7. Compute the beta of the portfolio? (1 mark) (1 mark) 8. Compute the non-systematic risk of the portfolio (1 mark) 9. Compute the standard deviation of the portfolio 5 6. Write in the appropriate box (4 marks) Returns for Paltel's Returns for Padico's Stock Stock Aggressive stock Higher firm specific risk Higher total risk In figure I below, Li represents the regression equation for Defensive stock Less systematic risk The market returns explain a greater fraction of return variability Higher alpha + Figure 1 Security Return (R) Market Return (R) Suppose that you were to construct a portfolio with proportions as follows: Paltel Stock 30%, Padico Stock 50%, and T-bill 20%. 7. Compute the beta of the portfolio? (1 mark) (1 mark) 8. Compute the non-systematic risk of the portfolio (1 mark) 9. Compute the standard deviation of the portfolio 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts