Question: You are asked to value a large building in northern New Jersey. The valuation is needed for a bankruptcy settlement. Here are the facts: ?

You are asked to value a large building in northern New Jersey. The valuation is needed for a bankruptcy settlement. Here are the facts:

? The settlement requires?that the building?s value equal the PV value of the net cash proceeds?the railroad would receive if it cleared the building and sold it for its highest and best non-railroad use, which is as a warehouse.

??The building has been appraised at $1 million. This figure is based on actual recent selling prices of a sample of similar New Jersey buildings used as, or available for use as, warehouses.

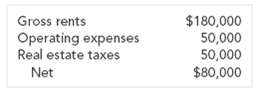

? If rented today as a warehouse, the building could generate $80,000 per year. This cash flow is calculated after?out-of-pocket operating expenses and after?real estate taxes of $50,000 per year:

Gross rents, operating expenses, and real estate taxes are uncertain but are expected to grow with inflation.

??However, it would take one year and $200,000 to clear out the railroad equipment and prepare the building for use as a warehouse. This expenditure would be spread evenly over the next year.

??The property will be put on the market when ready for use as a warehouse. Your real estate adviser says that properties of this type take, on average, 1 year to sell after they are put on the market. However, the railroad could rent the building as a warehouse while waiting for it to sell.

??The opportunity cost of capital for investment in real estate is 8 percent in real?terms.

??Your real estate adviser notes that selling prices of comparable buildings in northern

New Jersey?have declined, in real terms, at an average rate of 2 percent per year over the last 10 years.

??A 5 percent sales commission would be paid by the railroad at the time of the sale.

? The railroad pays no income taxes. It would have to pay property taxes.

$180,000 50,000 50,000 $80,000 Gross rents Operating expenses Real estate taxes Net

Step by Step Solution

3.38 Rating (173 Votes )

There are 3 Steps involved in it

If available for immediate occupancy the building would be worth 1 million But because ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-C-B (148).docx

120 KBs Word File