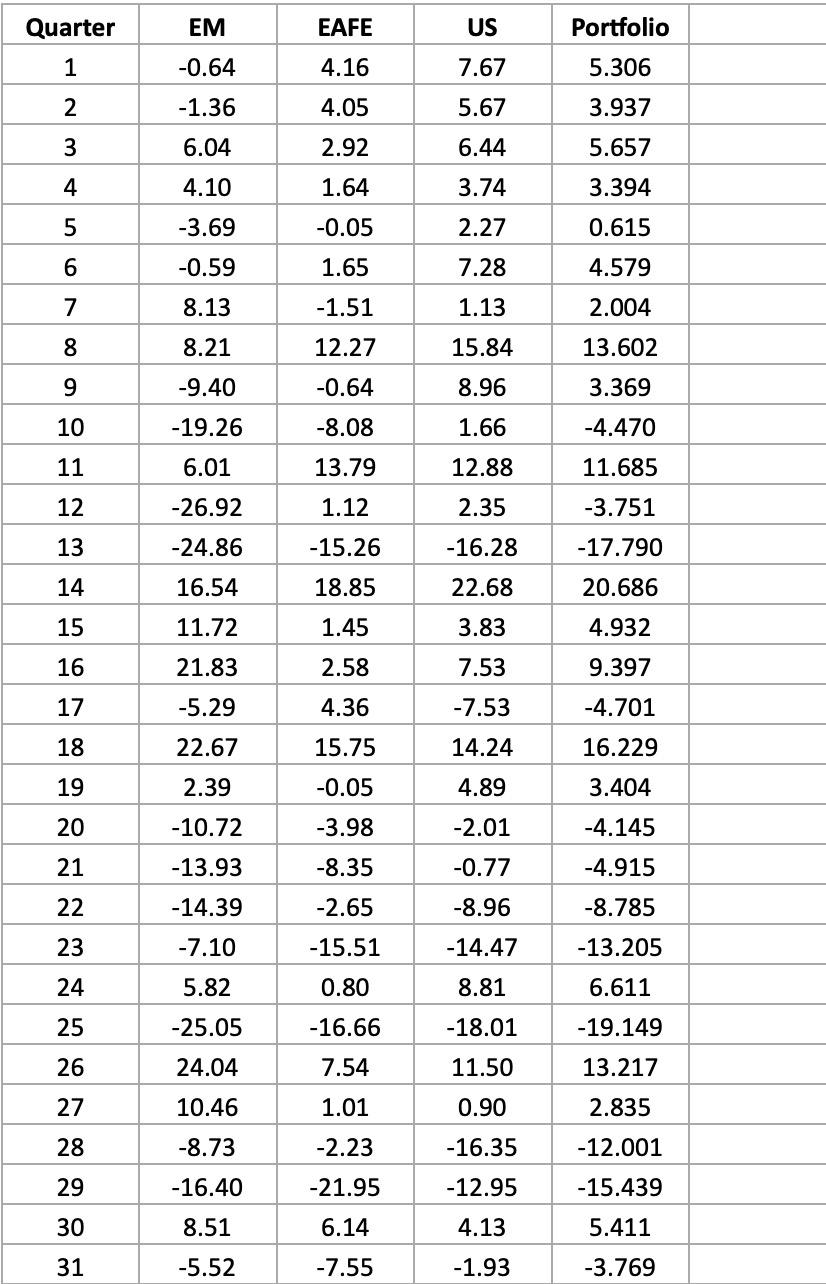

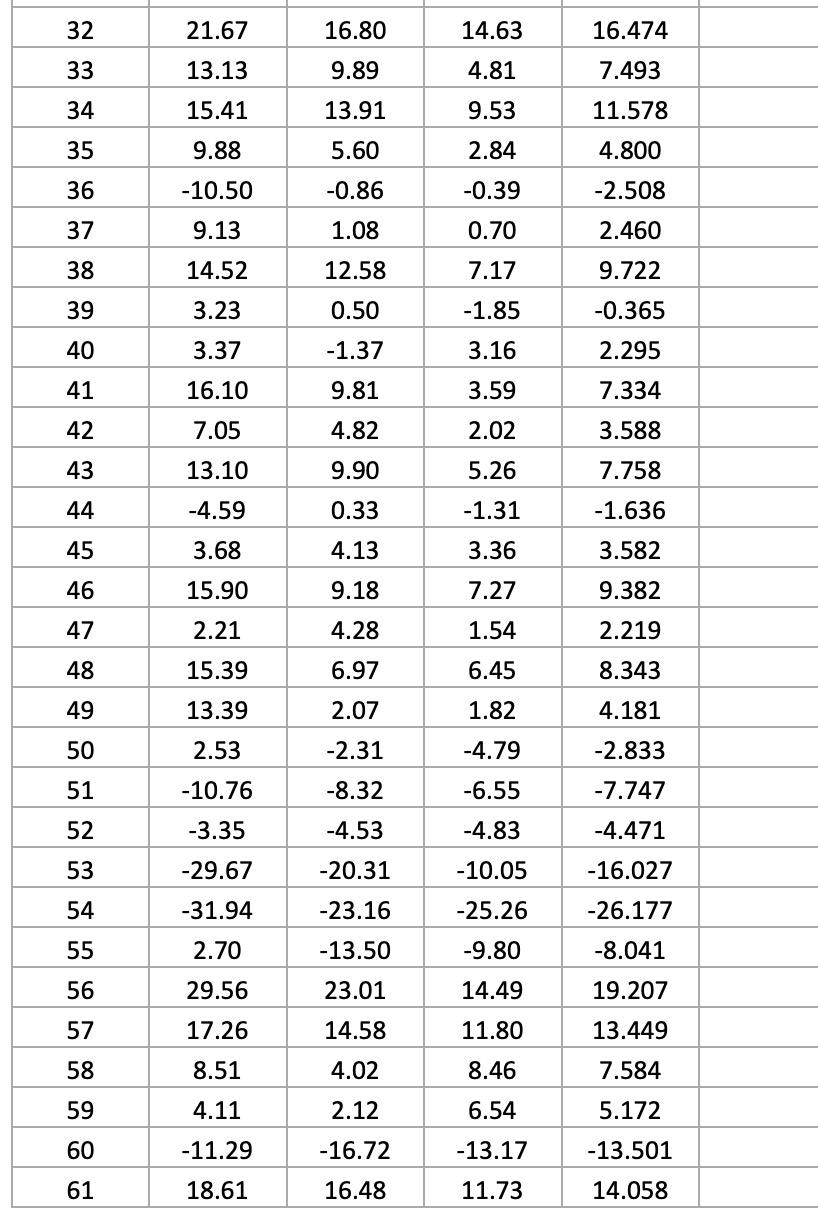

Question: 61 quarterly return data is provided for three assets: US Equities, Emerging Market (EM) Equities and Developed Markets (EAFE) ex US are provided in Excel

61 quarterly return data is provided for three assets: US Equities, Emerging Market (EM) Equities and Developed Markets (EAFE) ex US are provided in Excel file "Quiz 2.xlsx" in the tab "MV". Create a MV optimized portfolio that generates a return of 1.8% per quarter, and ensure that each asset has a minimum allocation of 5% and maximum of 100%. The volatility of this portfolio is:

10.54% per quarter

10.15% per quarter

No answer is possible since the required return is too low.

10.11% per quarter

No correct answer is provided for this question

Quarter EM EAFE US Portfolio 1 -0.64 4.16 7.67 5.306 2 -1.36 4.05 5.67 3.937 3 6.04 2.92 6.44 5.657 4 4.10 1.64 3.74 3.394 5 -3.69 -0.05 2.27 0.615 6 -0.59 1.65 7.28 4.579 7 8.13 -1.51 1.13 2.004 8 8.21 12.27 15.84 13.602 9 -9.40 -0.64 8.96 3.369 10 -19.26 -8.08 1.66 -4.470 11 6.01 13.79 12.88 11.685 12 -26.92 1.12 2.35 -3.751 13 -24.86 -15.26 -16.28 -17.790 14 16.54 18.85 22.68 20.686 15 11.72 1.45 3.83 4.932 1 16 21.83 2.58 7.53 9.397 17 -5.29 4.36 -7.53 -4.701 18 22.67 15.75 14.24 16.229 19 2.39 4.89 3.404 -0.05 -3.98 20 -10.72 -2.01 -4.145 -4.915 21 -13.93 -8.35 -0.77 22 -14.39 -2.65 -8.96 -8.785 23 -7.10 -15.51 -14.47 -13.205 24 5.82 0.80 8.81 6.611 25 -25.05 -16.66 -18.01 -19.149 26 24.04 7.54 11.50 13.217 27 10.46 1.01 0.90 2.835 28 -8.73 -2.23 -16.35 -12.001 29 -16.40 -21.95 -12.95 -15.439 30 8.51 6.14 4.13 5.411 31 -5.52 -7.55 -1.93 -3.769 32 21.67 16.80 14.63 16.474 33 13.13 9.89 4.81 7.493 34 15.41 13.91 9.53 11.578 35 9.88 5.60 2.84 4.800 36 -10.50 -0.86 -0.39 -2.508 37 9.13 1.08 0.70 2.460 38 14.52 12.58 7.17 9.722 39 3.23 0.50 -1.85 -0.365 40 3.37 -1.37 3.16 2.295 41 16.10 9.81 3.59 7.334 42 7.05 4.82 2.02 3.588 43 13.10 9.90 5.26 7.758 44 -4.59 0.33 -1.31 -1.636 45 3.68 4.13 3.36 3.582 46 15.90 9.18 7.27 9.382 47 2.21 4.28 1.54 2.219 48 15.39 6.97 6.45 8.343 49 13.39 2.07 1.82 4.181 50 2.53 -2.31 -4.79 -2.833 51 -10.76 -8.32 -6.55 -7.747 52 -3.35 -4.53 -4.83 -4.471 53 -29.67 -20.31 -10.05 -16.027 54 -31.94 -23.16 -25.26 -26.177 55 2.70 -13.50 -9.80 -8.041 56 29.56 23.01 14.49 19.207 57 17.26 14.58 11.80 13.449 58 8.51 4.02 8.46 7.584 59 4.11 2.12 6.54 5.172 60 -11.29 -16.72 -13.17 -13.501 61 18.61 16.48 11.73 14.058 Quarter EM EAFE US Portfolio 1 -0.64 4.16 7.67 5.306 2 -1.36 4.05 5.67 3.937 3 6.04 2.92 6.44 5.657 4 4.10 1.64 3.74 3.394 5 -3.69 -0.05 2.27 0.615 6 -0.59 1.65 7.28 4.579 7 8.13 -1.51 1.13 2.004 8 8.21 12.27 15.84 13.602 9 -9.40 -0.64 8.96 3.369 10 -19.26 -8.08 1.66 -4.470 11 6.01 13.79 12.88 11.685 12 -26.92 1.12 2.35 -3.751 13 -24.86 -15.26 -16.28 -17.790 14 16.54 18.85 22.68 20.686 15 11.72 1.45 3.83 4.932 1 16 21.83 2.58 7.53 9.397 17 -5.29 4.36 -7.53 -4.701 18 22.67 15.75 14.24 16.229 19 2.39 4.89 3.404 -0.05 -3.98 20 -10.72 -2.01 -4.145 -4.915 21 -13.93 -8.35 -0.77 22 -14.39 -2.65 -8.96 -8.785 23 -7.10 -15.51 -14.47 -13.205 24 5.82 0.80 8.81 6.611 25 -25.05 -16.66 -18.01 -19.149 26 24.04 7.54 11.50 13.217 27 10.46 1.01 0.90 2.835 28 -8.73 -2.23 -16.35 -12.001 29 -16.40 -21.95 -12.95 -15.439 30 8.51 6.14 4.13 5.411 31 -5.52 -7.55 -1.93 -3.769 32 21.67 16.80 14.63 16.474 33 13.13 9.89 4.81 7.493 34 15.41 13.91 9.53 11.578 35 9.88 5.60 2.84 4.800 36 -10.50 -0.86 -0.39 -2.508 37 9.13 1.08 0.70 2.460 38 14.52 12.58 7.17 9.722 39 3.23 0.50 -1.85 -0.365 40 3.37 -1.37 3.16 2.295 41 16.10 9.81 3.59 7.334 42 7.05 4.82 2.02 3.588 43 13.10 9.90 5.26 7.758 44 -4.59 0.33 -1.31 -1.636 45 3.68 4.13 3.36 3.582 46 15.90 9.18 7.27 9.382 47 2.21 4.28 1.54 2.219 48 15.39 6.97 6.45 8.343 49 13.39 2.07 1.82 4.181 50 2.53 -2.31 -4.79 -2.833 51 -10.76 -8.32 -6.55 -7.747 52 -3.35 -4.53 -4.83 -4.471 53 -29.67 -20.31 -10.05 -16.027 54 -31.94 -23.16 -25.26 -26.177 55 2.70 -13.50 -9.80 -8.041 56 29.56 23.01 14.49 19.207 57 17.26 14.58 11.80 13.449 58 8.51 4.02 8.46 7.584 59 4.11 2.12 6.54 5.172 60 -11.29 -16.72 -13.17 -13.501 61 18.61 16.48 11.73 14.058

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts