Question: 1.5 pts 60 quarterly return (in %) data is provided for three assets: US Government Bonds, US Corporate Bond and Emerging Market (EM) Aggregate are

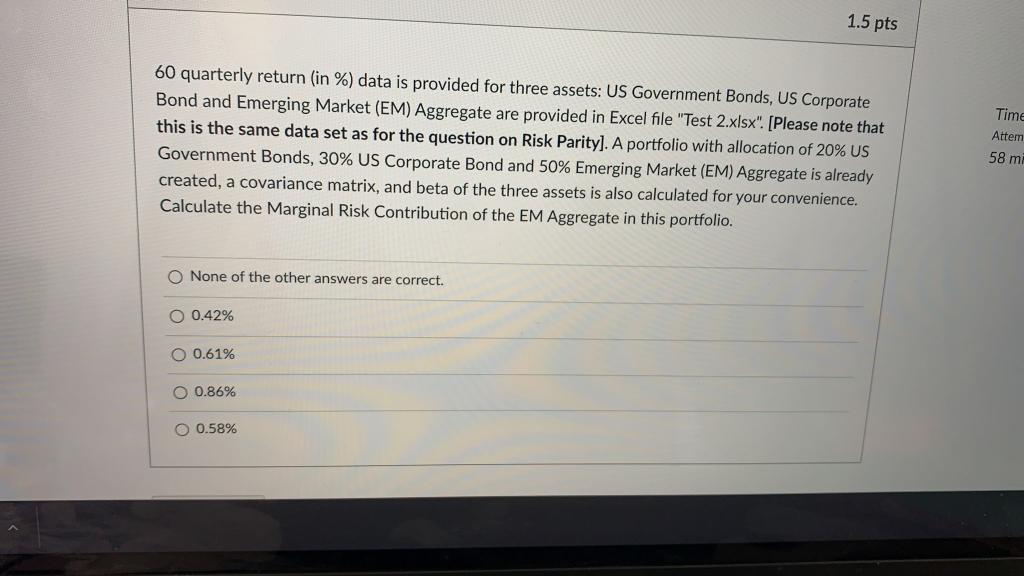

1.5 pts 60 quarterly return (in %) data is provided for three assets: US Government Bonds, US Corporate Bond and Emerging Market (EM) Aggregate are provided in Excel file "Test 2.xlsx". [Please note that this is the same data set as for the question on Risk Parity]. A portfolio with allocation of 20% US Government Bonds, 30% US Corporate Bond and 50% Emerging Market (EM) Aggregate is already created, a covariance matrix, and beta of the three assets is also calculated for your convenience. Calculate the Marginal Risk Contribution of the EM Aggregate in this portfolio. Time Attem 58 m O None of the other answers are correct. O 0.42% O 0.61% O 0.86% O 0.58% 1.5 pts 60 quarterly return (in %) data is provided for three assets: US Government Bonds, US Corporate Bond and Emerging Market (EM) Aggregate are provided in Excel file "Test 2.xlsx". [Please note that this is the same data set as for the question on Risk Parity]. A portfolio with allocation of 20% US Government Bonds, 30% US Corporate Bond and 50% Emerging Market (EM) Aggregate is already created, a covariance matrix, and beta of the three assets is also calculated for your convenience. Calculate the Marginal Risk Contribution of the EM Aggregate in this portfolio. Time Attem 58 m O None of the other answers are correct. O 0.42% O 0.61% O 0.86% O 0.58%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts