Question: 6-14. (Expected return, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard & Poor's 500 Index and

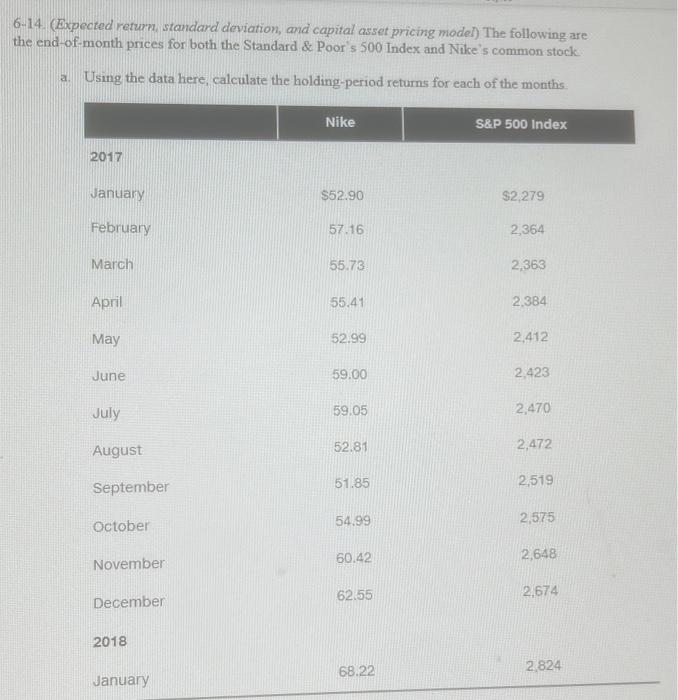

6-14. (Expected return, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard \& Poor's 500 Index and Nike's common stock a. Using the data here, calculate the holding-period returns for each of the months b. Calculate the average monthly return and the standard deviation for both the S\&P 500 and Nike. c. Develop a graph that shows the relationship between the Nike stock returns and the S\&P 500 Index. (Show the Nike retums on the vertical axis and the S\&P 500 Index returns on the horizontal axis as done in Figure 6-5.) d. From your graph, describe the nature of the relationship between Nike stock returns and the returns for the S\&P 500 Index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts