Question: (Expected return, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard & Poor's 500 Index and Nike's

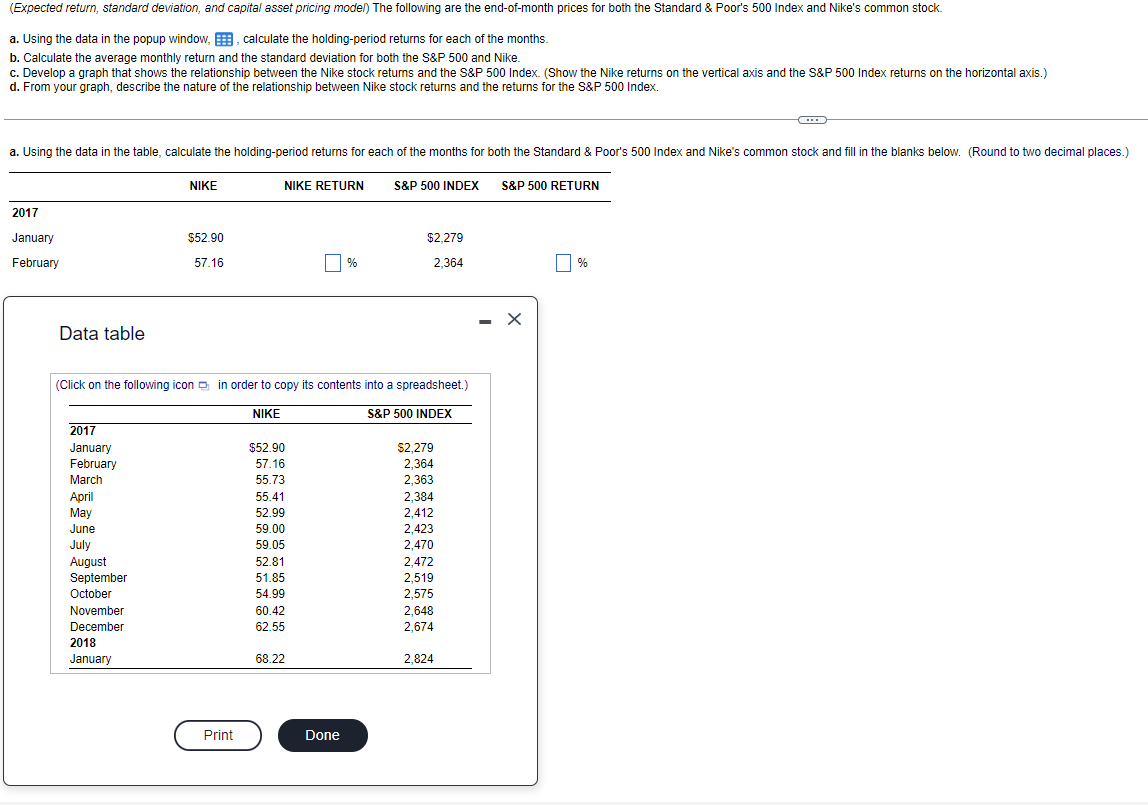

(Expected return, standard deviation, and capital asset pricing model) The following are the end-of-month prices for both the Standard & Poor's 500 Index and Nike's common stock.

a. Using the data in the popup window, calculate the holding-period returns for each of the months.

b. Calculate the average monthly return and the standard deviation for both the S&P 500 and Nike.

c. Develop a graph that shows the relationship between the Nike stock returns and the S&P 500 Index. (Show the Nike returns on the vertical axis and the S&P 500 Index returns on the horizontal axis.)

d. From your graph, describe the nature of the relationship between Nike stock returns and the returns for the S&P 500 Index.

a. Using the data in the table, calculate the holding-period returns for each of the months for both the Standard & Poor's 500 Index and Nike's common stock and fill in the blanks below. (Round to two decimal places.)

a. Using the data in the popup window,_ calculate the holding-period returns for each of the months. b. Calculate the average monthly return and the standard deviation for both the S\&P 500 and Nike. d. From your graph, describe the nature of the relationship between Nike stock returns and the returns for the S\&P 500 Index. Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts