Question: 6.25 pts You have been asked to predict the shape of the yield curve using Traditional Term Structure Theories. The results of your analysis is

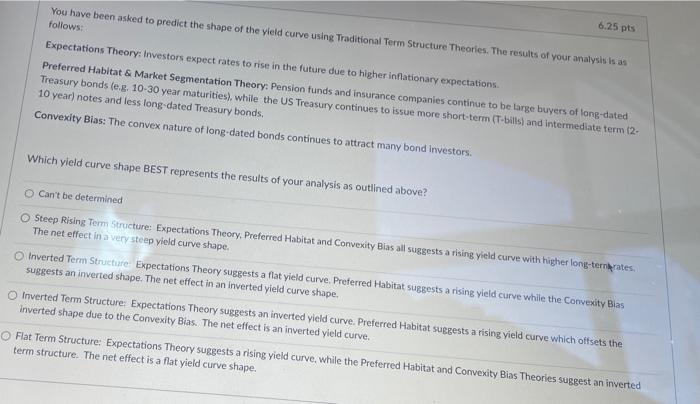

6.25 pts You have been asked to predict the shape of the yield curve using Traditional Term Structure Theories. The results of your analysis is as follows: Expectations Theory: Investors expect rates to rise in the future due to higher inflationary expectations. Preferred Habitat & Market Segmentation Theory, Pension funds and insurance companies continue to be large buyers of long-dated Treasury bonds (e.g. 10-30 year maturities), while the US Treasury continues to issue more short-term (T-bills, and intermediate term 12- 10 year) notes and less long dated Treasury bonds. Convexity Bias: The convex nature of long-dated bonds continues to attract many bond investors. Which yield curve shape BEST represents the results of your analysis as outlined above? Can't be determined Steep Rising Term Structure: Expectations Theory, Preferred Habitat and Convexity Bias all suggests a rising yield curve with higher long-term rates, The net effect in a very steep yield curve shape. Inverted Term Structure Expectations Theory suggests a flat yield curve. Preferred Habitat suggests a rising yield curve while the Convexity Bias suggests an inverted shape. The net effect in an inverted yield curve shape. Inverted Term Structure: Expectations Theory suggests an inverted yield curve. Preferred Habitat suggests a rising yield curve which offsets the inverted shape due to the Convexity Blas. The net effect is an inverted yield curve. Flat Term Structure: Expectations Theory suggests arising yield curve, while the Preferred Habitat and Convexity Bias Theories suggest an inverted term structure. The net effect is a flat yield curve shape

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts