Question: 6:41PM Sat Oct 19 . . . O ( 86% Chapter 8 Depr Calc Problem 2024 5 A + ... B I U S A

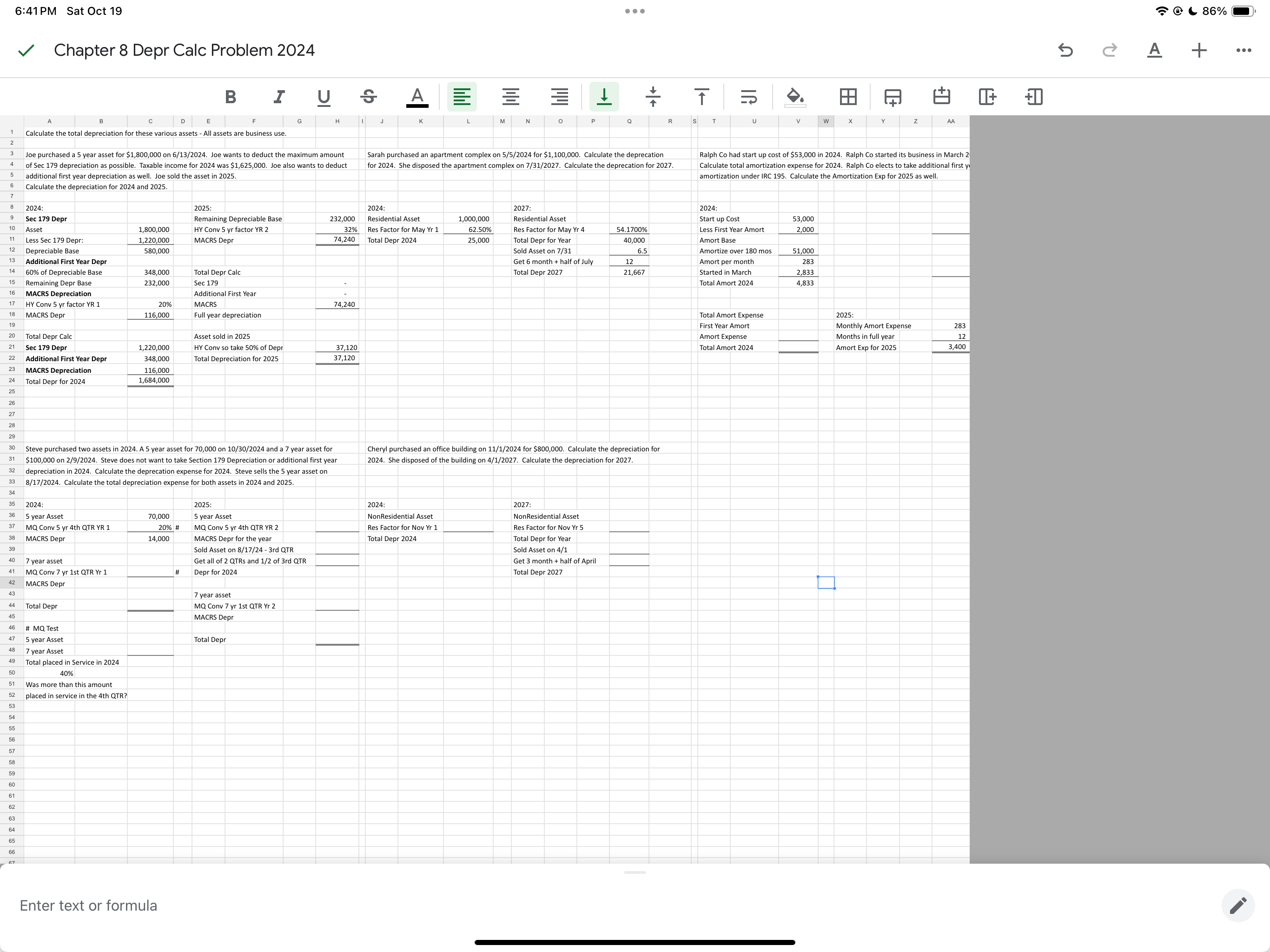

6:41PM Sat Oct 19 . . . O ( 86% Chapter 8 Depr Calc Problem 2024 5 A + ... B I U S A Ep D. D AA Calculate the total depreciation for these various assets - All assets are business use. Joe purchased a 5 year asset for $1,800,000 on 6/13/2024. Joe wants to deduct the maximum amount Sarah purchased an apartment complex on 5/5/2024 for $1,100,000. Calculate the deprecation Ralph Co had start up cost of $53,000 in 2024. Ralph Co started its business in March 2 of Sec 179 depreciation as possible. Taxable income for 2024 was $1,625,000. Joe also wants to deduct for 2024. She disposed the apartment complex on 7/31/2027. Calculate the deprecation for 2027. Calculate total amortization expense for 2024. Ralph Co elects to take additional first y additional first year depreciation as well. Joe sold the asset in 2025. amortization under IRC 195. Calculate the Amortization Exp for 2025 as well. Calculate the depreciation for 2024 and 2025. 2024: 2025: 2024: 2027: 2024: Sec 179 Depr Remaining Depreciable Base 232,000 Residential Asset 1,000,000 Residential Asset Asset Start up Cost 53,000 1,800,000 nv 5 yr factor YR 2 32% Res Factor for May Yr 1 62.50% Res Factor for May Yr 4 $4.1700% Less First Ye 2,000 Less Sec 179 Depr 1,220,000 MACRS Depr 74,240 Total Depr 2024 25,000 Total Depr for Year 40,000 Amort Base 12 Depreciable Base 580,000 Sold Asset on 7/31 6.5 Amortize over 180 mos 51,000 Additional First Year Depr Get 6 month + half of July Amort per mont 283 60% of Depreciable Base 348,000 Total Depr Calc Total Depr 2027 21, 667 started in March 2,833 Remaining Depr Base 232,000 Sec 179 Total Amort 2024 4,833 16 Additional First Year 17 MACRS Depreci HY Conv 5 yr factor YR 1 20% 74,240 MACRS Depr 116,000 Full year depreciation Total Amort Expense 2025: First Year Amort Monthly Amort Expense Total Depr Cal Asset sold in 2025 Amort Expense Months in full year 285 Sec 179 Depr 220,000 HY Conv so take 50% of Depr 37,120 Total Amort 2024 Amort Exp for 2025 3, 400 22 Additional First Year Depr 348,000 Total Depreciation for 2025 37,120 23 MACRS Depreciation 116,000 Total Depr for 2024 1,684,000 4 8 8 Steve purchased two assets in 2024. A 5 year asset for 70,000 on 10/30/2024 and a 7 year asset for Cheryl purchased an office building on 11/1/2024 for $800,000. Calculate the depreciation for $100,000 on 2/9/2024. Steve does not want to take Section 179 Depreciation or additional first year 2024. She disposed of the building on 4/1/2027. Calculate the depreciation for 2027. depreciation in 2024. Calculate the deprecation expense for 2024. Steve sells the 5 year asset on 33 8/17/2024. Calculate the total depreciation expense for both assets in 2024 and 2025. 2024 2025 2024: 2027: 36 5 year Asset 70,000 5 year Asset NonResidential Asset NonResidential Asset 37 MQ Conv 5 yr 4th QTR YR 1 20% # MQ Conv 5 yr 4th QTR YR 2 Res Factor for Nov Yr 1 Res Factor for Nov Yr 5 38 MACRS Depr 14,000 MACRS Depr for the year Total Depr 2024 39 Total Depr for Yea Sold Asset on 8/17/24 - 3rd QTR Sold Asset on 4/1 40 7 year asset Get all of 2 QTRs and 1/2 of 3rd QTR Get 3 month + half of April 41 MQ Conv 7 yr 1st QTR Yr 1 Depr for 2024 Total Depr 2027 42 MACRS Depr 7 year asset 44 Total Depr MQ Conv 7 yr 1st QTR Yr 2 MACRS Depr 46 47 # MQ Test 5 year Asset Total Depr 48 7 year Asset 49 Total placed in Service in 2024 50 40% Was more than this amount 52 placed in service e in the 4th QTR 53 8 9 8 8 9 8 8 63 3 8 Enter text or formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts