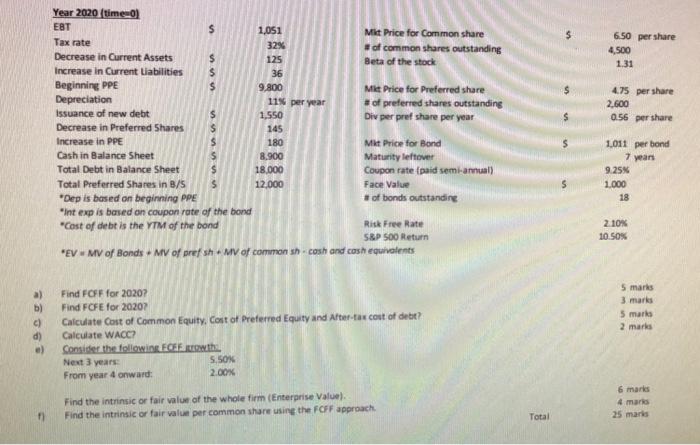

Question: $ $ 6.50 per share 4,500 1.31 $ $ 4.75 per share 2,600 0.56 per share Year 2020 (time) EBT 1,051 Mit Price for Common

$ $ 6.50 per share 4,500 1.31 $ $ 4.75 per share 2,600 0.56 per share Year 2020 (time) EBT 1,051 Mit Price for Common share Tax rate 32% of common shares outstanding Decrease in Current Assets $ 125 Beta of the stock Increase in Current Liabilities $ 36 Beginning PPE $ 9.800 Mit Price for Preferred share Depreciation 11% per year # of preferred shares outstanding Issuance of new debt 1,550 Div per pret share per year Decrease in Preferred Shares 145 Increase in PPE 180 Mit Price for Bond Cash in Balance Sheet 8.900 Maturity leftover Total Debt in Balance Sheet 18.000 Coupon rate (paid semi-annual) Total Preferred Shares in B/S 12.000 Face Value *Dep is based on beginning PPE of bonds outstanding *int exp is based on coupon rate of the bond "Cost of debt is the YTM of the bond Risk Free Rate S&P 500 Return "EV. MV of Bonds MV of prefsh MV of common sh.cosh and cash equivalents un 1,011 per bond 7 years 9.25% 1.000 18 2. 10% 10.50 a) b) c) d) .) 5 marks 3 marks 5 marka 2 marts Find FCFF for 20207 Find FCFE for 2020? Calculate Cost of Common Equity, Cost of Preferred Equity and After-tax cout of debe? Calculate WACC? Consider the following Erowth Next 3 years 5.50% From year 4 onward: 2.00% Find the intrinsic or fair value of the whole firm (Enterprise Value). Find the intrinsic or fair value per common share using the FOFF approach 6 marts 4 mars 25 maris Total $ $ 6.50 per share 4,500 1.31 $ $ 4.75 per share 2,600 0.56 per share Year 2020 (time) EBT 1,051 Mit Price for Common share Tax rate 32% of common shares outstanding Decrease in Current Assets $ 125 Beta of the stock Increase in Current Liabilities $ 36 Beginning PPE $ 9.800 Mit Price for Preferred share Depreciation 11% per year # of preferred shares outstanding Issuance of new debt 1,550 Div per pret share per year Decrease in Preferred Shares 145 Increase in PPE 180 Mit Price for Bond Cash in Balance Sheet 8.900 Maturity leftover Total Debt in Balance Sheet 18.000 Coupon rate (paid semi-annual) Total Preferred Shares in B/S 12.000 Face Value *Dep is based on beginning PPE of bonds outstanding *int exp is based on coupon rate of the bond "Cost of debt is the YTM of the bond Risk Free Rate S&P 500 Return "EV. MV of Bonds MV of prefsh MV of common sh.cosh and cash equivalents un 1,011 per bond 7 years 9.25% 1.000 18 2. 10% 10.50 a) b) c) d) .) 5 marks 3 marks 5 marka 2 marts Find FCFF for 20207 Find FCFE for 2020? Calculate Cost of Common Equity, Cost of Preferred Equity and After-tax cout of debe? Calculate WACC? Consider the following Erowth Next 3 years 5.50% From year 4 onward: 2.00% Find the intrinsic or fair value of the whole firm (Enterprise Value). Find the intrinsic or fair value per common share using the FOFF approach 6 marts 4 mars 25 maris Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts