Question: 67 Homework #3 Problem 3-1 Complete Fluff, Inc. Your home ework will always include finishing whatever was opleted during class and reading all pages up

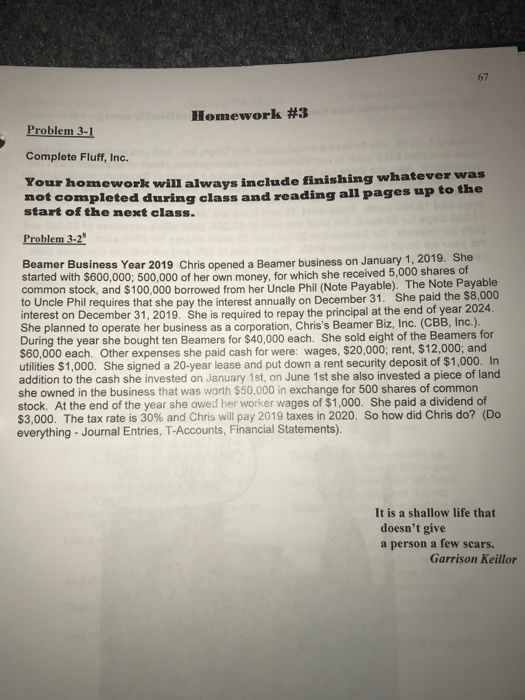

67 Homework #3 Problem 3-1 Complete Fluff, Inc. Your home ework will always include finishing whatever was opleted during class and reading all pages up to the start of the next class. Problem 3-2 , 2019. She Beamer Business Year 2019 Chris opened a Beamer business on January 1 started with $600,000; 500,000 of her own money, for which she received 5,000 shares of common stock, and $100,000 borrowed from her Uncle Phil (Note Payable). The Note Payable to Uncle Phil requires that she pay the interest annually on December 31. She paid the $8,000 interest on December 31, 2019. She is required to repay the principal at the end of year 2024. She planned to operate her business as a corporation, Chris's Beamer Biz, Inc. (CBB, Inc.). During the year she bought ten Beamers for $40,000 each. She sold eight of the Beamers for $60,000 each. Other expenses she paid cash for were: wages, $20,000; rent, $12,000; and utilities $1,000. She signed a 20-year lease and put down a rent security deposit of $1,000. In addition to the cash she invested on January 1st, on June 1st she also invested a piece of land she owned in the business that was worth $50,000 in exchange for 500 shares of common stock. At the end of the year she owed her worker wages of $1,000. She paid a dividend of $3,000. The tax rate is 30% and Chris will pay 2019 taxes in 2020, So how did Chris do? (Do everything - Journal Entries, T-Accounts, Financial Statements). It is a shallow life that doesn't give a person a few scars. Garrison Keillor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts