Question: Problem 3-1 Module 3 Homework Complete Chris's Beamer Biz, Inc. Your homework will always include finishing whatever was not completed during class and reading all

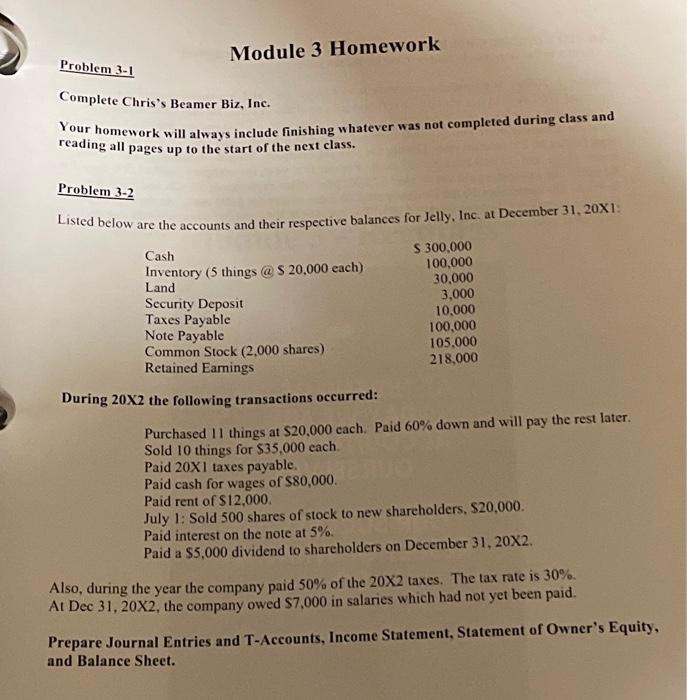

Complete Chris's Beamer Biz, Inc. Your homework will always include finishing whatever was not completed during class and reading all pages up to the start of the next class. Problem 3-2 Listed below are the accounts and their respective balances for Jelly, Inc. at December 31,201 : During 20X2 the following transactions occurred: Purchased 11 things at $20,000 cach. Paid 60% down and will pay the rest later. Sold 10 things for $35,000 each. Paid 20X1 taxes payable. Paid cash for wages of $80,000. Paid rent of $12,000. July 1: Sold 500 shares of stock to new shareholders, $20,000. Paid interest on the note at 5%. Paid a $5,000 dividend to shareholders on December 31,202. Also, during the year the company paid 50% of the 202 taxes. The tax rate is 30%. At Dec 31,202, the company owed $7,000 in salaries which had not yet been paid. Prepare Journal Entries and T-Accounts, Income Statement, Statement of Owner's Equity, and Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts