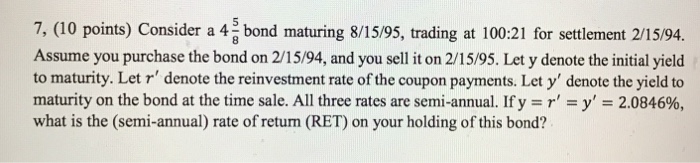

Question: 7, (10 points) Consider a 4 j bond maturing 8/15/9s, trading at 100:21 for settlement 2/15/94. Assume you purchase the bond on 2/15/94, and you

7, (10 points) Consider a 4 j bond maturing 8/15/9s, trading at 100:21 for settlement 2/15/94. Assume you purchase the bond on 2/15/94, and you sell it on 2/15/95. Let y denote the initial yield to maturity. Let r' denote the reinvestment rate of the coupon payments. Let y' denote the yield to maturity on the bond at the time sale. All three rates are semi-annual. If y-r,-y, 2.0846%, what is the (semi-annual) rate of return (RET) on your holding of this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts