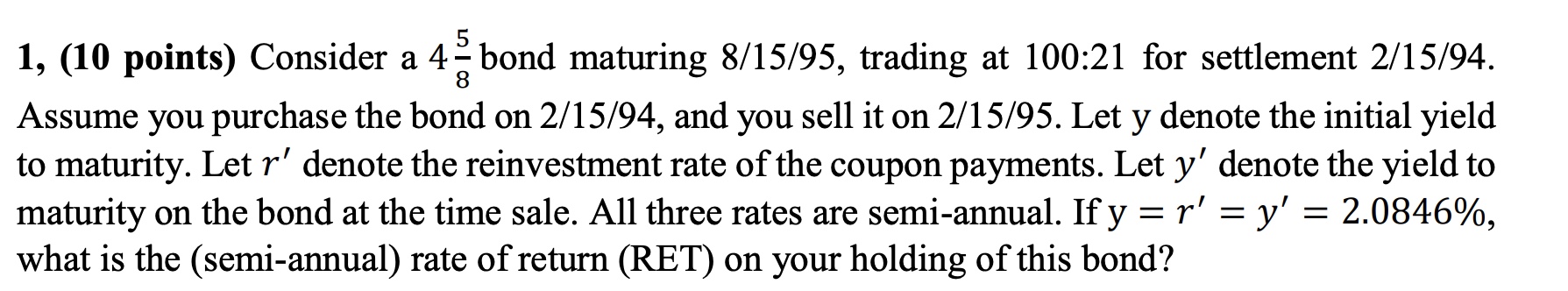

Question: 1, (10 points) Consider a 485 bond maturing 8/15/95, trading at 100:21 for settlement 2/15/94. Assume you purchase the bond on 2/15/94, and you sell

1, (10 points) Consider a 485 bond maturing 8/15/95, trading at 100:21 for settlement 2/15/94. Assume you purchase the bond on 2/15/94, and you sell it on 2/15/95. Let y denote the initial yield to maturity. Let r denote the reinvestment rate of the coupon payments. Let y denote the yield to maturity on the bond at the time sale. All three rates are semi-annual. If y=r=y=2.0846%, what is the (semi-annual) rate of return (RET) on your holding of this bond

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock