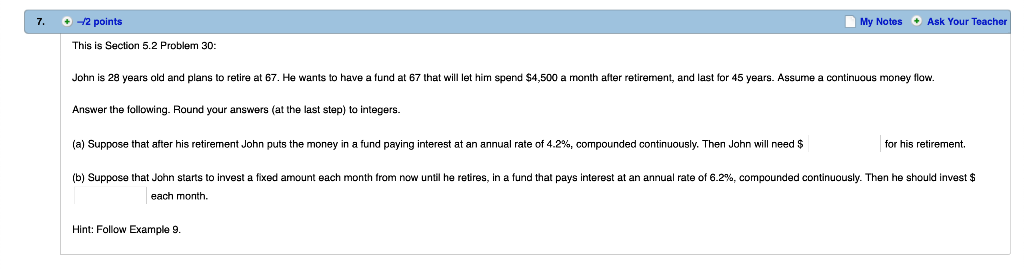

Question: 7. 2 points My Notes Ask Your Teacher This is Section 5.2 Problem 30: John is 28 years old and plans to retire at 67.

7. 2 points My Notes Ask Your Teacher This is Section 5.2 Problem 30: John is 28 years old and plans to retire at 67. He wants to have a fund at 67 that wll let him spend $4,500 a month after retirerment, and last for 45 years. Assume a continuous money flow. Answer the following. Round your answers (at the last step) to integers. (a Suppose that after his retirement John puts the money in a fund paying interest a an annual rate o 4.2%, compounded continuously. Then n need b uppose that John starts to invest a fixed amount each month rom now unti he retire in a un that pays interest at an annual rateo 62% compounded continuous hen he should in as for his retirement. each month. Hint: Follow Example 9. 7. 2 points My Notes Ask Your Teacher This is Section 5.2 Problem 30: John is 28 years old and plans to retire at 67. He wants to have a fund at 67 that wll let him spend $4,500 a month after retirerment, and last for 45 years. Assume a continuous money flow. Answer the following. Round your answers (at the last step) to integers. (a Suppose that after his retirement John puts the money in a fund paying interest a an annual rate o 4.2%, compounded continuously. Then n need b uppose that John starts to invest a fixed amount each month rom now unti he retire in a un that pays interest at an annual rateo 62% compounded continuous hen he should in as for his retirement. each month. Hint: Follow Example 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts