Question: 7 - 3 4 . Refer to Problem 6 - 7 7 . The alternatives all have a MACRS ( GDS ) property class of

Refer to Problem The alternatives all have a MACRS GDS property class of three years. If the effective income tax rate is and the aftertax MARR per year, which alternative should be recommended? Is this the same recommendation you made when the alternatives were analyzed on a beforetax basis?

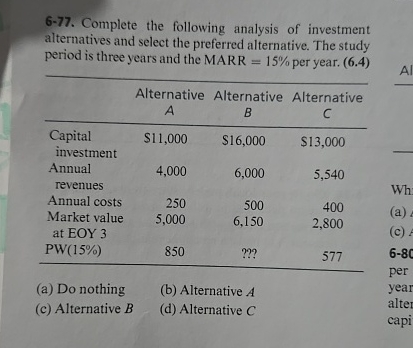

Complete the following analysis of investment alternatives and select the preferred alternative. The study period is three years and the MARR per year.

tableAlternative AAlternative Alternative CCapital investment,$$$Annual revenues,Annual costs,Market value at EOY PW

a Do nothing

b Alternative

c Alternative

d Alternative

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock