Question: 7. A 12b-1 fee is a fee charged by a mutual fund: A. at the time shares are issued. B. if shares are sold within

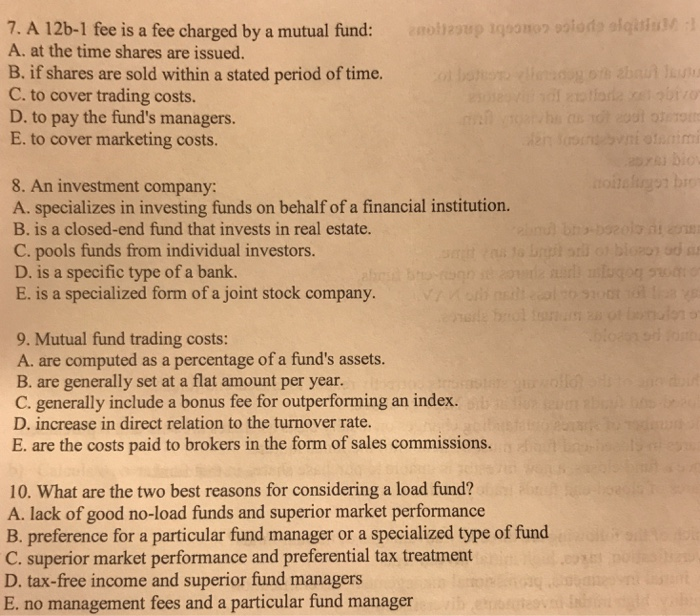

7. A 12b-1 fee is a fee charged by a mutual fund: A. at the time shares are issued. B. if shares are sold within a stated period of time. C. to cover trading costs. D. to pay the fund's managers. E. to cover marketing costs. 8. An investment company A. specializes in investing funds on behalf of a financial institution. B. is a closed-end fund that invests in real estate. C. pools funds from individual investors. D. is a specific type of a bank. E. is a specialized form of a joint stock company 9. Mutual fund trading costs: A. are computed as a percentage of a fund's assets. B. are generally set at a flat amount per year. C. generally include a bonus fee for outperforming an index. D. increase in direct relation to the turnover rate. E. are the costs paid to brokers in the form of sales commissions. 10. What are the two best reasons for considering a load fund? A. lack of good no-load funds and superior market performance B. preference for a particular fund manager or a specialized type of fund C. superior market performance and preferential tax treatment D. tax-free income and superior fund managers E. no management fees and a particular fund manager

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts