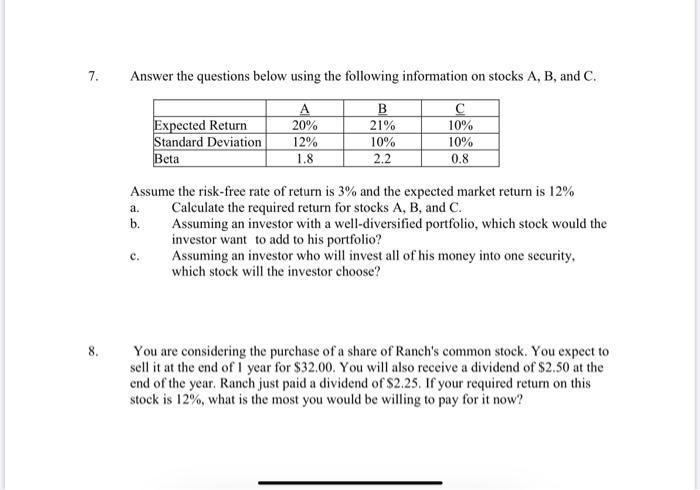

Question: 7. Answer the questions below using the following information on stocks A, B, and C. A B C Expected Return 20% 21% 10% Standard

7. Answer the questions below using the following information on stocks A, B, and C. A B C Expected Return 20% 21% 10% Standard Deviation 12% 10% 10% Beta 1.8 2.2 0.8 Assume the risk-free rate of return is 3% and the expected market return is 12% Calculate the required return for stocks A, B, and C. a. b. c. Assuming an investor with a well-diversified portfolio, which stock would the investor want to add to his portfolio? Assuming an investor who will invest all of his money into one security, which stock will the investor choose? 8. You are considering the purchase of a share of Ranch's common stock. You expect to sell it at the end of 1 year for $32.00. You will also receive a dividend of $2.50 at the end of the year. Ranch just paid a dividend of $2.25. If your required return on this stock is 12%, what is the most you would be willing to pay for it now?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts