Question: 7. Capital Structure - MM proposition Novelty PIc a) A firm that has employed no debt in its capital structure in the past is considering

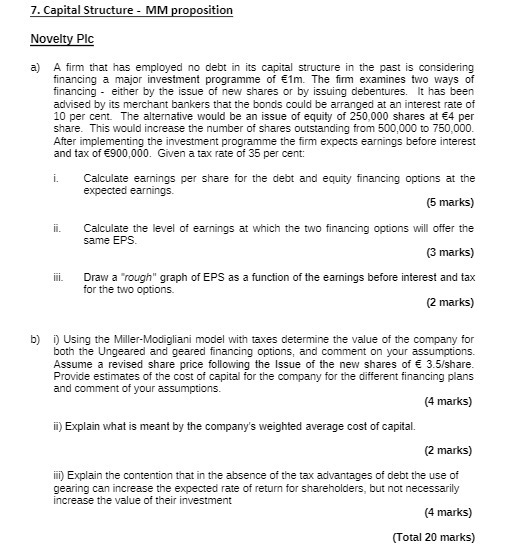

7. Capital Structure - MM proposition Novelty PIc a) A firm that has employed no debt in its capital structure in the past is considering financing a major investment programme of E1m. The firm examines two ways of financing - either by the issue of new shares or by issuing debentures. It has been advised by its merchant bankers that the bonds could be arranged at an interest rate of 10 per cent The alternative would be an issue of equity of 250,000 shares at $4 per share. This would increase the number of shares outstanding from 500,000 to 750,000. After implementing the investment programme the firm expects earnings before interest and tax of 6900,000. Given a tax rate of 35 per cent: i. Calculate earnings per share for the debt and equity financing options at the expected earnings. (5 marks) ii. Calculate the level of earnings at which the two financing options will offer the same EPS. (3 marks) iii. Draw a "rough" graph of EPS as a function of the earnings before interest and tax. for the two options. (2 marks) bj "i) Using the Miller-Modigliani model with taxes determine the value of the company for both the Ungeared and geared financing options, and comment on your assumptions. Assume a revised share price following the Issue of the new shares of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts