Question: 7. Conflicts between two mutually exclusive projects, where the NPV method chooses one project but the IRR method chooses the other, should generally be resolved

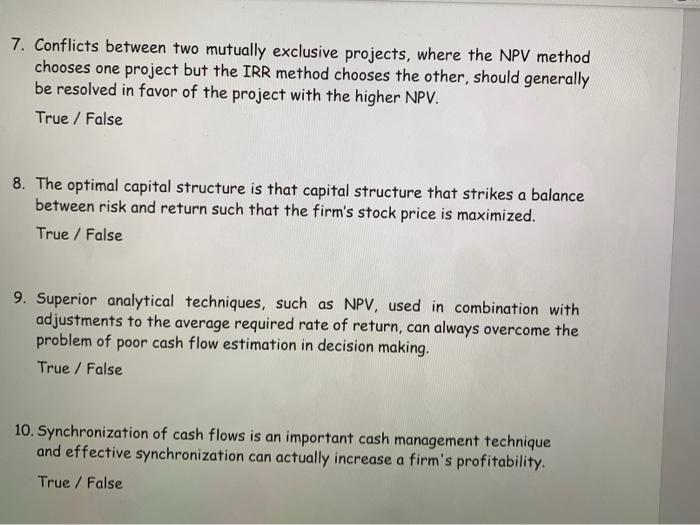

7. Conflicts between two mutually exclusive projects, where the NPV method chooses one project but the IRR method chooses the other, should generally be resolved in favor of the project with the higher NPV. True / False 8. The optimal capital structure is that capital structure that strikes a balance between risk and return such that the firm's stock price is maximized. True / False 9. Superior analytical techniques, such as NPV, used in combination with adjustments to the average required rate of return, can always overcome the problem of poor cash flow estimation in decision making. True / False 10. Synchronization of cash flows is an important cash management technique and effective synchronization can actually increase a firm's profitability. True / False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts