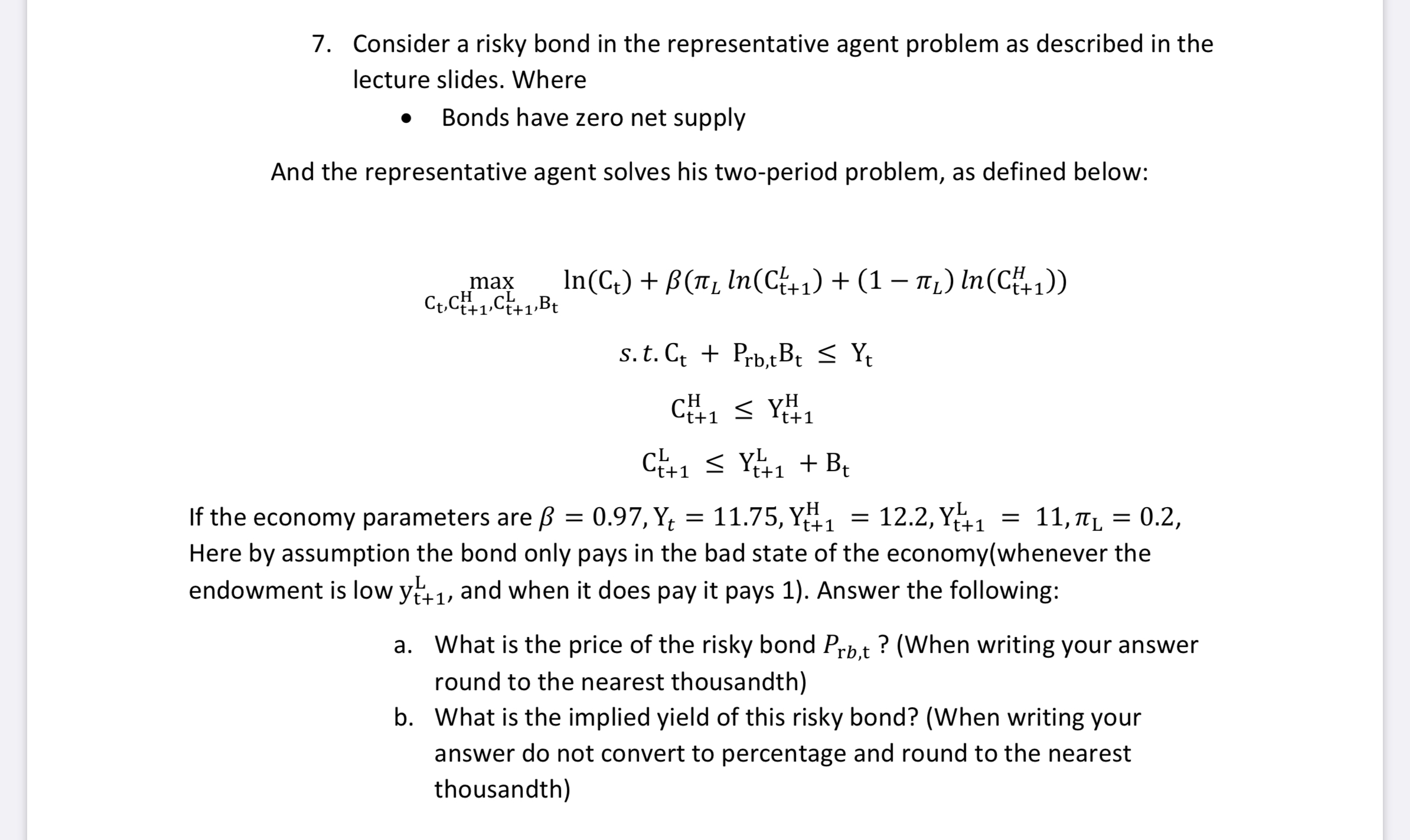

Question: 7. Consider a risky bond in the representative agent problem as described in the lecture slides. Where . Bonds have zero net supply And the

7. Consider a risky bond in the representative agent problem as described in the lecture slides. Where . Bonds have zero net supply And the representative agent solves his two-period problem, as defined below: max Ct, CH+ 1 . Ct+ 1, Bt In (Ct) + B(TL In(Ct+1) + (1 -TL) In(Ct+1)) s. t. Ct + Prb,t Bt S Yt t+1 { YH CH+1 S Y +1 + By If the economy parameters are B = 0.97, Yt = 11.75, Y(+ 1 = 12.2, Y(+1 = 11, my = 0.2, Here by assumption the bond only pays in the bad state of the economy(whenever the endowment is low yt+ 1, and when it does pay it pays 1). Answer the following: a. What is the price of the risky bond Prb,t ? (When writing your answer round to the nearest thousandth) b. What is the implied yield of this risky bond? (When writing your answer do not convert to percentage and round to the nearest thousandth)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts