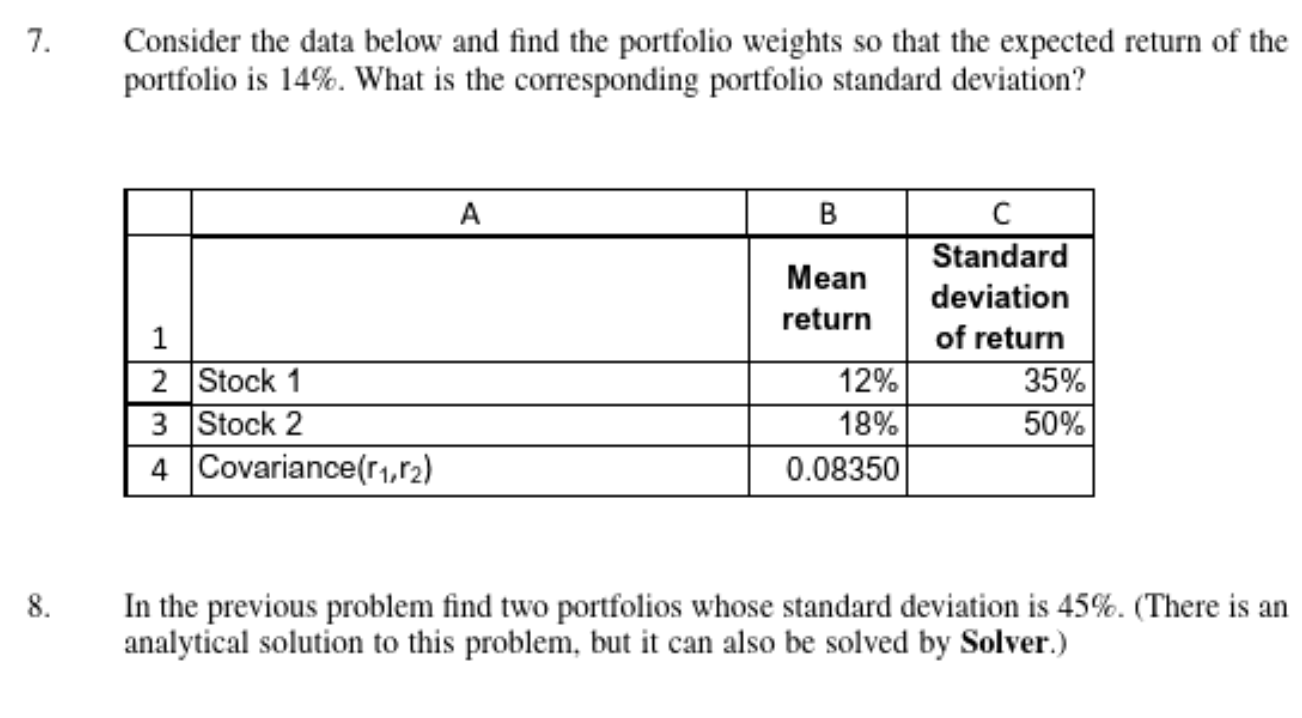

Question: 7. Consider the data below and find the portfolio weights so that the expected return of the portfolio is 14%. What is the corresponding portfolio

7. Consider the data below and find the portfolio weights so that the expected return of the portfolio is 14%. What is the corresponding portfolio standard deviation? B Mean return Standard deviation of return 35% 50% 1 2 Stock 1 3 Stock 2 4 Covariance(11,12) 12% 18% 0.08350 8. In the previous problem find two portfolios whose standard deviation is 45%. (There is an analytical solution to this problem, but it can also be solved by Solver.) See Chapter 8 Exercise 7. Compute the corresponding portfolio standard deviation (If the answer is 12.34%, then submit 12.34 instead of 0.1234 or 12.34%. See Chapter 8 Exercise 8. What is the weight for Stock 1 if the portfolio standard deviation is 45%? (If the answer is 12.34%, then submit 12.34 instead of 0.1234 or 12.34%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts