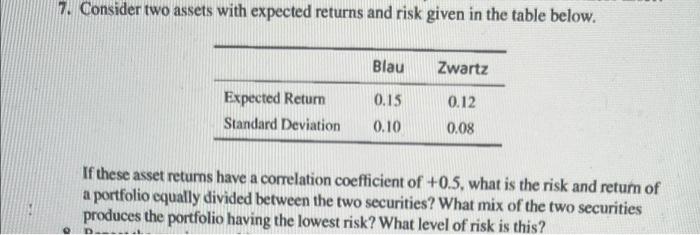

Question: 7. Consider two assets with expected returns and risk given in the table below. Blau Zwartz 0.15 Expected Return Standard Deviation 0.12 0.08 0.10 If

7. Consider two assets with expected returns and risk given in the table below. Blau Zwartz 0.15 Expected Return Standard Deviation 0.12 0.08 0.10 If these asset returns have a correlation coefficient of +0.5, what is the risk and return of a portfolio equally divided between the two securities? What mix of the two securities produces the portfolio having the lowest risk? What level of risk is this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts