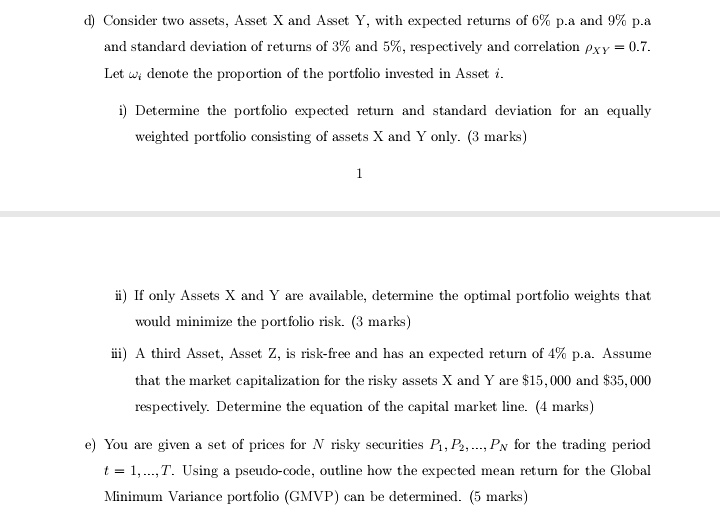

Question: d ) Consider two assets, Asset X and Asset Y , with expected returns of 6 % p . a and 9 % p .

d Consider two assets, Asset X and Asset Y with expected returns of pa and pa

and standard deviation of returns of and respectively and correlation

Let denote the proportion of the portfolio invested in Asset

i Determine the portfolio expected return and standard deviation for an equally

weighted portfolio consisting of assets and only. marks

ii If only Assets and are available, determine the optimal portfolio weights that

would minimize the portfolio risk. marks

iii A third Asset, Asset Z is riskfree and has an expected return of pa Assume

that the market capitalization for the risky assets and are $ and $

respectively. Determine the equation of the capital market line. marks

e You are given a set of prices for risky securities dots, for the trading period

dots, Using a pseudocode, outline how the expected mean return for the Global

Minimum Variance portfolio GMVP can be determined. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock