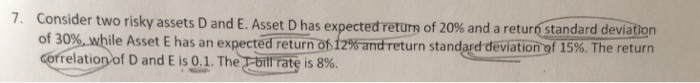

Question: 7. Consider two risky assets D and E. Asset D has expected return of 20% and a return standard deviation of 30%, while Asset E

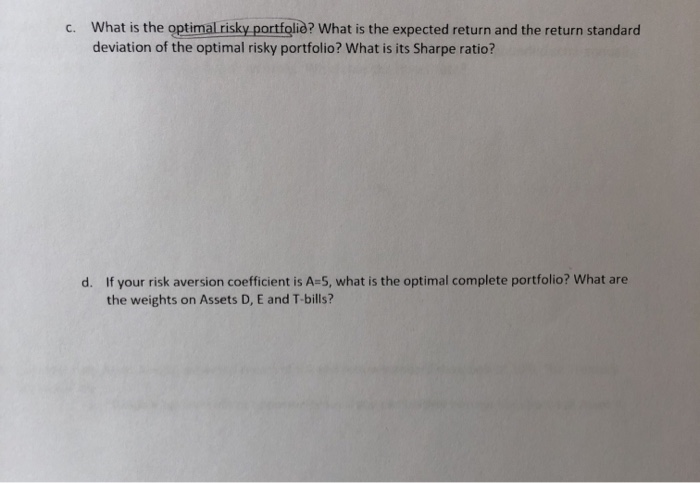

7. Consider two risky assets D and E. Asset D has expected return of 20% and a return standard deviation of 30%, while Asset E has an expected return of 12% and return standard deviation of 15%. The return correlation of D and Eis 0.1. The T-bill rate is 8%. C. What is the optimal risky portfolid? What is the expected return and the return standard deviation of the optimal risky portfolio? What is its Sharpe ratio? d. If your risk aversion coefficient is A-5, what is the optimal complete portfolio? What are the weights on Assets D, E and T-bills? 7. Consider two risky assets D and E. Asset D has expected return of 20% and a return standard deviation of 30%, while Asset E has an expected return of 12% and return standard deviation of 15%. The return correlation of D and Eis 0.1. The T-bill rate is 8%. C. What is the optimal risky portfolid? What is the expected return and the return standard deviation of the optimal risky portfolio? What is its Sharpe ratio? d. If your risk aversion coefficient is A-5, what is the optimal complete portfolio? What are the weights on Assets D, E and T-bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts