Question: URGENT: PLEASE, I NEED YOUR HELP! Hello, If you could please help me answer the following question, that would be much appreciated. This homework assignment

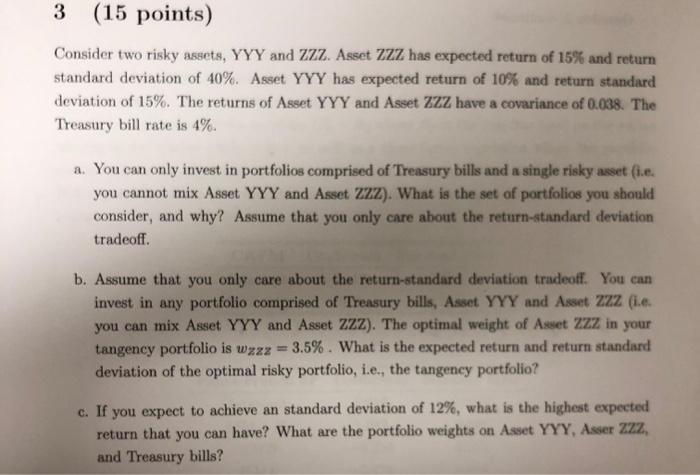

3 (15 points) Consider two risky assets, YYY and ZZZ. Asset ZZZ has expected return of 15% and return standard deviation of 40%. Asset YYY has expected return of 10% and return standard deviation of 15%. The returns of Asset YYY and Asset ZZZ have a covariance of 0.038. The Treasury bill rate is 4%. a. You can only invest in portfolios comprised of Treasury bills and a single risky asset (ie. you cannot mix Asset YYY and Asset ZZZ). What is the set of portfolios you should consider, and why? Assume that you only care about the return-standard deviation tradeoff. b. Assume that you only care about the return-standard deviation tradeoff. You can invest in any portfolio comprised of Treasury bills, Asset YYY and Asset ZZZ (ie. you can mix Asset YYY and Asset ZZZ). The optimal weight of Asset ZZZ in your tangency portfolio is wzzz = 3.596. what is the expected return and return standard deviation of the optimal risky portfolio, i.e., the tangeney portfolio? c. If you expect to achieve an standard deviation of 12%, what is the highest expected return that you can have? What are the portfolio weights on Asset YYY, Asser ZZZ, and Treasury bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts