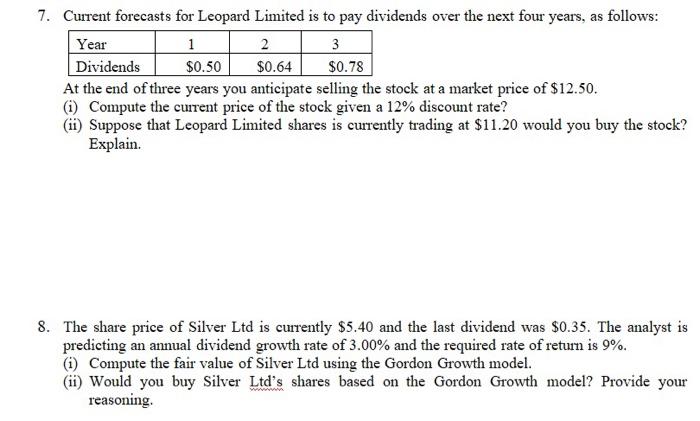

Question: 7. Current forecasts for Leopard Limited is to pay dividends over the next four years, as follows: Year 1 2 3 Dividends $0.50 $0.64 $0.78

7. Current forecasts for Leopard Limited is to pay dividends over the next four years, as follows: Year 1 2 3 Dividends $0.50 $0.64 $0.78 At the end of three years you anticipate selling the stock at a market price of $12.50. (1) Compute the current price of the stock given a 12% discount rate? (ii) Suppose that Leopard Limited shares is currently trading at $11.20 would you buy the stock? Explain. 8. The share price of Silver Ltd is currently $5.40 and the last dividend was $0.35. The analyst is predicting an annual dividend growth rate of 3.00% and the required rate of return is 9%. (1) Compute the fair value of Silver Ltd using the Gordon Growth model. (ii) Would you buy Silver Ltd's shares based on the Gordon Growth model? Provide your reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts