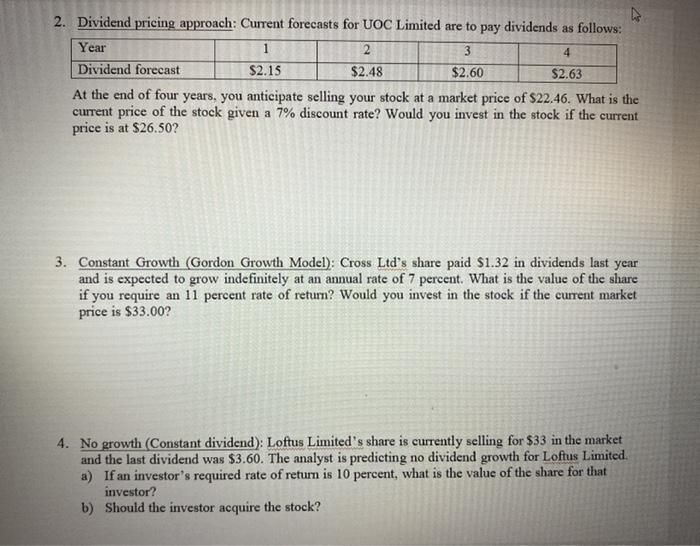

Question: 2. Dividend pricing approach: Current forecasts for UOC Limited are to pay dividends as follows: Year 2 3 4 Dividend forecast $2.15 $2.48 $2.60 $2.63

2. Dividend pricing approach: Current forecasts for UOC Limited are to pay dividends as follows: Year 2 3 4 Dividend forecast $2.15 $2.48 $2.60 $2.63 At the end of four years, you anticipate selling your stock at a market price of $22.46. What is the current price of the stock given a 7% discount rate? Would you invest in the stock if the current price is at $26.50? 3. Constant Growth (Gordon Growth Model): Cross Ltd's share paid $1.32 in dividends last year and is expected to grow indefinitely at an annual rate of 7 percent. What is the value of the share if you require an 11 percent rate of return? Would you invest in the stock if the current market price is $33.00? 4. No growth (Constant dividend): Loftus Limited's share is currently selling for $33 in the market and the last dividend was $3.60. The analyst is predicting no dividend growth for Loftus Limited. a) If an investor's required rate of return is 10 percent, what is the value of the share for that investor? b) Should the investor acquire the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts