Question: 7. Du Pont Analysis. Use the data for Phone Corp. from Question 4-1 to confirm that ROA - asset turnover x operating profit margin. (Note:

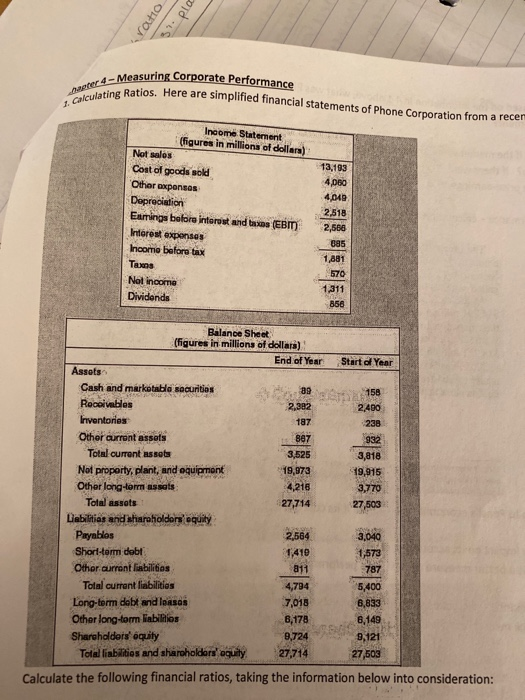

7. Du Pont Analysis. Use the data for Phone Corp. from Question 4-1 to confirm that ROA - asset turnover x operating profit margin. (Note: use "average" total assets for the year). ratio 31. plot Gagter 4-Me Measuring Corporate Performance Ratios. Here are simplified financial statements of Phone Corporation from a recer 1. Calculating Ratios 13,193 4,060 4049 Income Statement (figures in millions of dollars) Not salos Cost of goods sold Other expenses Depreciation Esminga before interest and taxas (EBIT) Interest expenses Income before tax Tax Not income Dividends 2,518 2.568 187 238 807 Balance Sheet (figures in millions of dollars) End of Year Start of Year Assots Cash and marketable securities 158 Receivables 2.382 2,400 Inventories Other current assots 932 Total current assets 3,525 3,818 Not proporty, plant, and equipment 19,073 19,915 Other long-term assets 4,216 3,770 Total assets 27,714 27,503 Liabilities and shareholders equity Payables 2564 Short-term debt 1,410 1,573 Other current liabilities 811 787 Total current liabilities 5,400 Long-term debt and leases 7,018 6,833 Other long-term liabilities 8,178 6,149 Shareholders' quity 8,724 Total liabilities and sharoholders' equity 27,503 Calculate the following financial ratios, taking the information below into consideration: 3.040 4794 9,121 27,714

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts