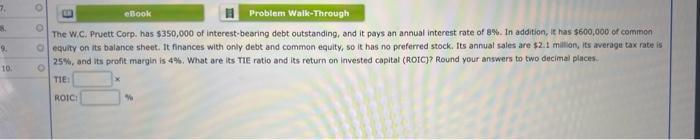

Question: 7 E 94 eBook Problem Walk-Through The W.C. Pruett Corp, has $350,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 8%.

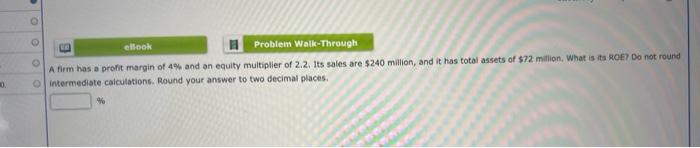

7 E 94 eBook Problem Walk-Through The W.C. Pruett Corp, has $350,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 8%. In addition, it has $600,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $2.1 million, its average tax rate is 25%, and its profit margin is 4%. What are its TIE ratio and its return on invested capital (ROIC)? Round your answers to two decimal places TIE: 10 ROIC 0 O elook Problem Walk-Through A firm has a profit margin of 4% and an equity multiplier of 2.2. Its sales are $240 million, and it has total assets of $72 million. What is its ROE? Do not round o intermediate calculations. Round your answer to two decimal places. 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts