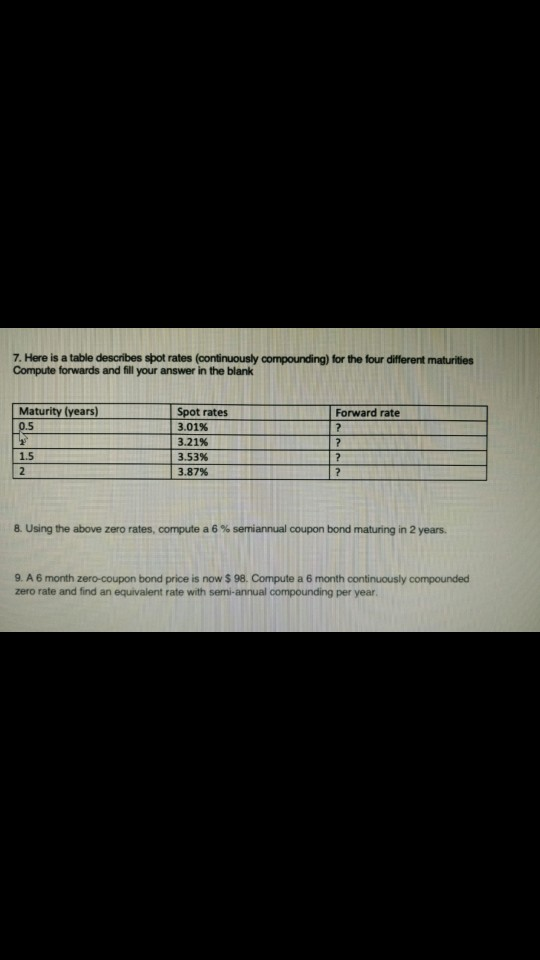

Question: 7. Here is a table describes spot rates (continuously compounding) for the four different maturities Compute forwards and fill your answer in the blank Maturity

7. Here is a table describes spot rates (continuously compounding) for the four different maturities Compute forwards and fill your answer in the blank Maturity (years) 0.5 Forward rate ? Spot rates 3.01% 3.21% 3.53% .87% 1.5 2 3 8. Using the above zero rates, compute a 6% semiannual coupon bond maturing in 2 years. 9. A 6 month zero-coupon bond price is now $ 98. Compute a 6 month continuously compounded zero rate and find an equivalent rate with semi-annual compounding per year. 7. Here is a table describes spot rates (continuously compounding) for the four different maturities Compute forwards and fill your answer in the blank Maturity (years) 0.5 Forward rate ? Spot rates 3.01% 3.21% 3.53% .87% 1.5 2 3 8. Using the above zero rates, compute a 6% semiannual coupon bond maturing in 2 years. 9. A 6 month zero-coupon bond price is now $ 98. Compute a 6 month continuously compounded zero rate and find an equivalent rate with semi-annual compounding per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts