Question: need help with question 5 and 6 Question 22 30 points Save Answer Here is a table describes spot rates (continuously compounding) for the four

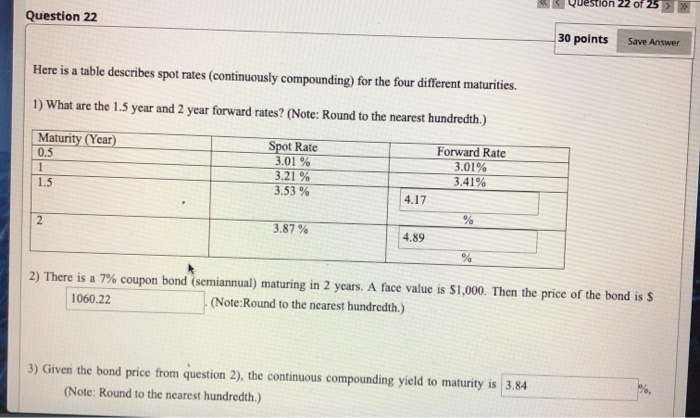

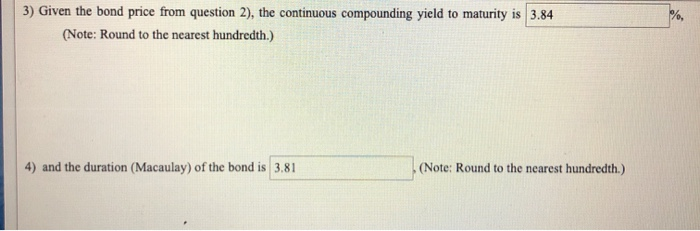

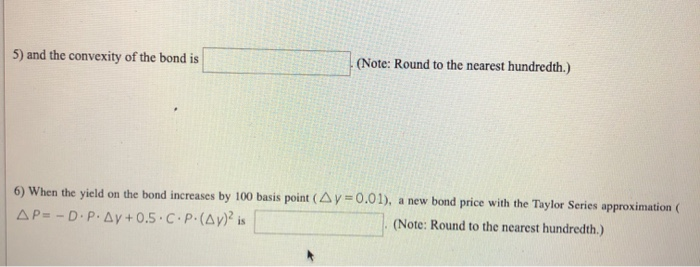

Question 22 30 points Save Answer Here is a table describes spot rates (continuously compounding) for the four different maturities. 1) What are the 1.5 year and 2 year forward rates? (Note: Round to the nearest hundredth.) Maturity (Year) 0.5 Spot Rate 3.01 % 3.21 % 3.53 % Forward Rate 3.01% 3.41% 4.17 3.87% 489 2) There is a 7% coupon bond (semiannual) maturing in 2 years. A face value is $1,000. Then the price of the bond is $ 1060.22 (Note:Round to the nearest hundredth.) 3) Given the bond price from question 2), the continuous compounding yield to maturity is 3.84 (Note: Round to the nearest hundredth.) 3) Given the bond price from question 2), the continuous compounding yield to maturity is 3.84 (Note: Round to the nearest hundredth.) 4) and the duration (Macaulay) of the bond is 3.81 (Note: Round to the nearest hundredth.) 5) and the convexity of the bond is (Note: Round to the nearest hundredth.) 6) When the yield on the bond increases by 100 basis point (Ay=0.01), a new bond price with the Taylor Series approximation AP= - D.P.Ay+0.5.C.P.(Ay)? is (Note: Round to the nearest hundredth.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts