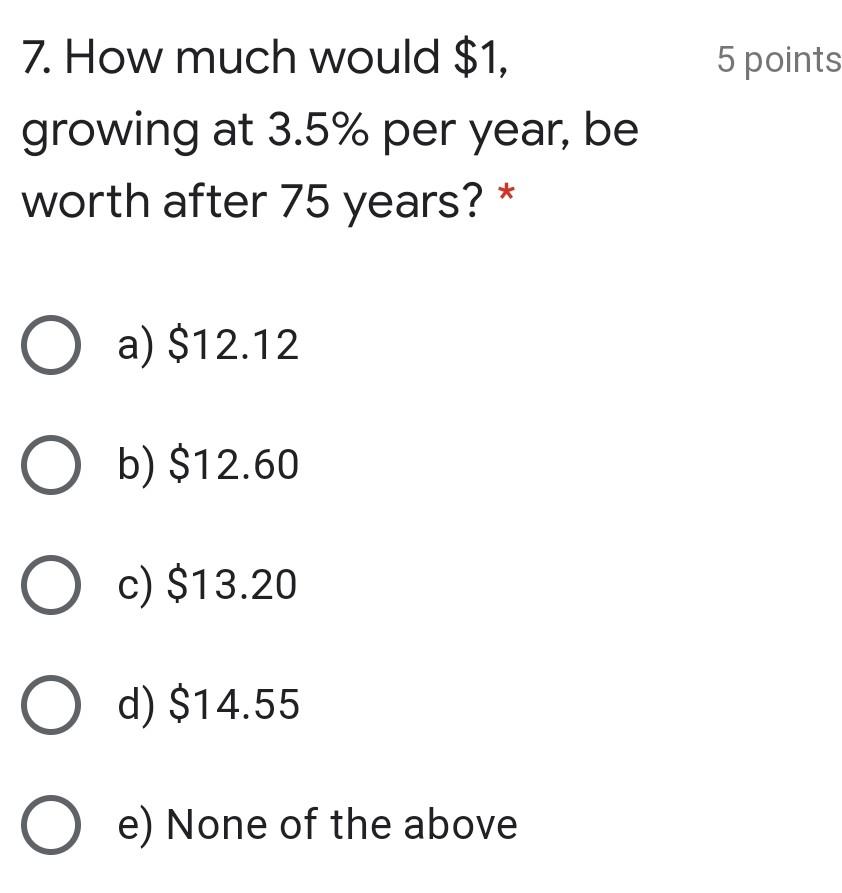

Question: 7. How much would $1. 5 points growing at 3.5% per year, be worth after 75 years? * O a) $12.12 O b) $12.60 O

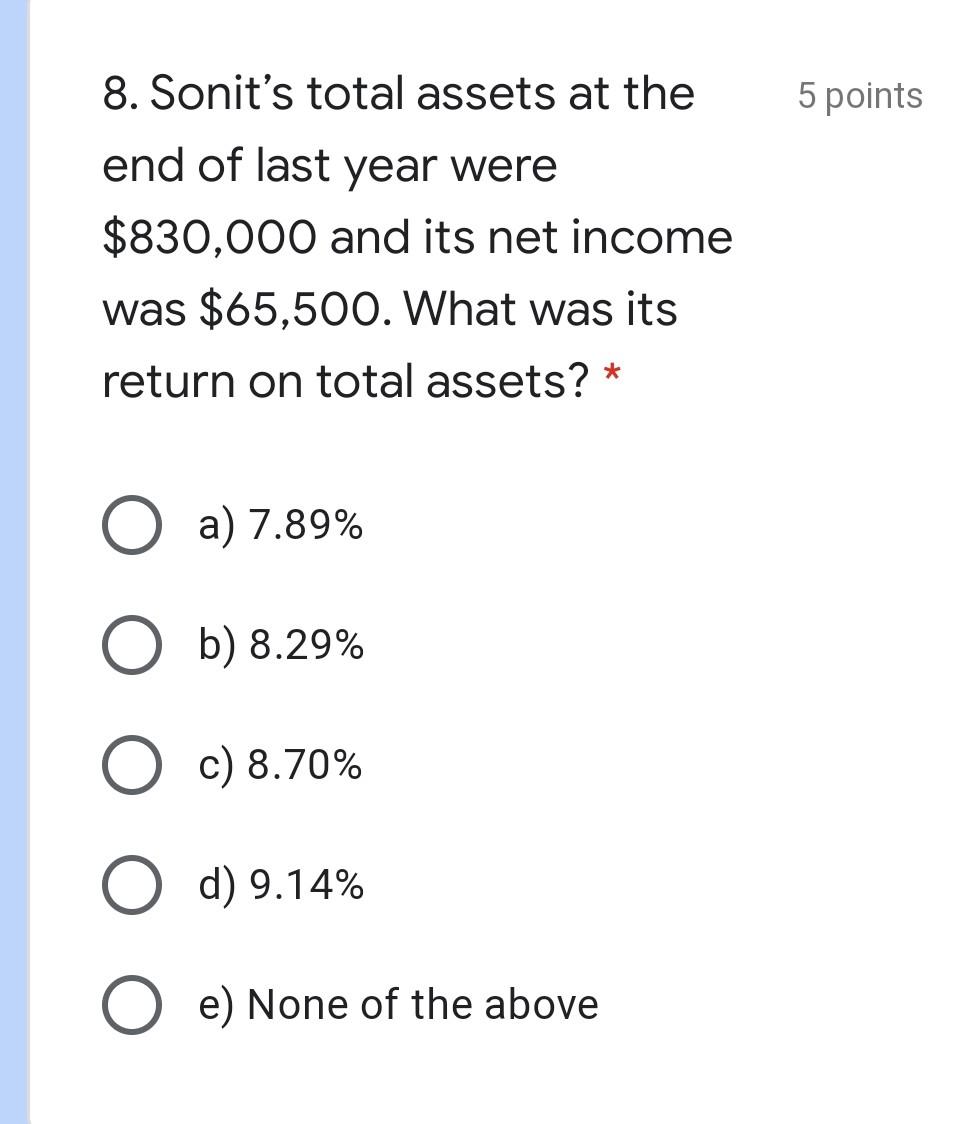

7. How much would $1. 5 points growing at 3.5% per year, be worth after 75 years? * O a) $12.12 O b) $12.60 O c) $13.20 O d) $14.55 O e) None of the above 8. Sonit's total assets at the 5 points end of last year were $830,000 and its net income was $65,500. What was its return on total assets? * a) 7.89% b) 8.29% O c) 8.70% O d) 9.14% e) None of the above 5 points 9. Suppose you need $1,000 ten years from now to settle your university education fees. If the interest rate is 5.5%, how much should you deposit today in the bank? * a) $585.43 b) $614.70 c) $645.44 d) $677.71 e) None of the above 10. Royal Corp's sales last year 5 points were $560,000, and its net income was $46,000. What was its profit margin? * a) 7.41% b) 7.80% c) 8.21% d) 8.63% e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts