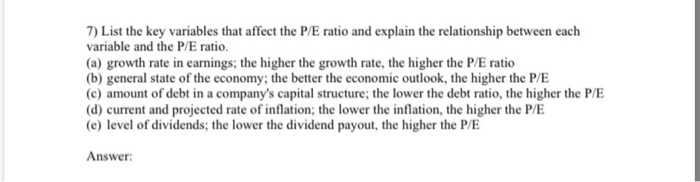

Question: 7) List the key variables that affect the P/E ratio and explain the relationship between each variable and the P/E ratio. (a) growth rate in

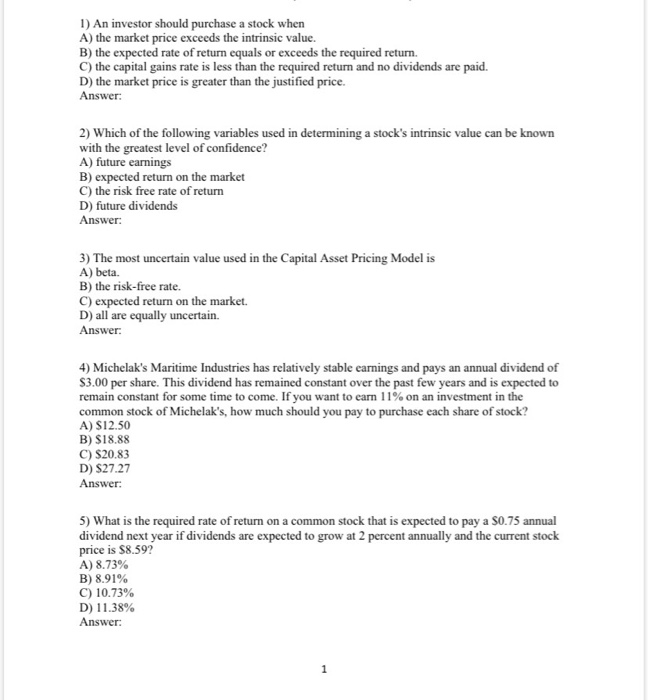

7) List the key variables that affect the P/E ratio and explain the relationship between each variable and the P/E ratio. (a) growth rate in earnings; the higher the growth rate, the higher the P/E ratio (b) general state of the economy, the better the economic outlook, the higher the P/E (e) amount of debt in a company's capital structure; the lower the debt ratio, the higher the P/E (d) current and projected rate of inflation; the lower the inflation, the higher the P/E (e) level of dividends, the lower the dividend payout, the higher the P/E Answer: 1) An investor should purchase a stock when A) the market price exceeds the intrinsic value. B) the expected rate of return equals or exceeds the required return. C) the capital gains rate is less than the required return and no dividends are paid. D) the market price is greater than the justified price. Answer: 2) Which of the following variables used in determining a stock's intrinsic value can be known with the greatest level of confidence? A) future earnings B) expected return on the market C) the risk free rate of return D) future dividends Answer: 3) The most uncertain value used in the Capital Asset Pricing Model is A) beta. B) the risk-free rate. C) expected return on the market. D) all are equally uncertain. Answer: 4) Michelak's Maritime Industries has relatively stable earnings and pays an annual dividend of $3.00 per share. This dividend has remained constant over the past few years and is expected to remain constant for some time to come. If you want to earn 11% on an investment in the common stock of Michelak's, how much should you pay to purchase each share of stock? A) S12.50 B) $18.88 C) $20.83 D) $27.27 Answer: 5) What is the required rate of return on a common stock that is expected to pay a S0.75 annual dividend next year if dividends are expected to grow at 2 percent annually and the current stock price is $8.592 A) 8.73% B) 8.91% C) 10.73% D) 11.38%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts